Insurance companies face a recurring challenge with EIOPA risk-free rate (RFR) data processing. While EIOPA provides comprehensive data in Excel format, transforming this analyst-friendly format into machine-readable data for automated processing creates significant operational friction. This article explores practical solutions for EIOPA RFR data automation, helping insurance companies streamline their regulatory compliance processes.

The Excel Challenge: When Friendly Becomes Complicated

Insurance companies worldwide rely on EIOPA’s risk-free rate term structures for various regulatory calculations. The Excel format, while perfect for human analysis, becomes a bottleneck in automated processes. The challenge multiplies when dealing with historical data analysis or when multiple teams need to access the same information. Actuaries find themselves spending valuable time on data transformation rather than risk analysis. As one actuary pointed out during a recent conference – it’s like trying to feed a JSON file to your grandmother’s recipe book. Not impossible, but definitely not what either party had in mind.

Navigating the Solution Landscape

The Excel Macro Approach: When Simple Gets Complex

Excel macro automation represents the most straightforward approach to handling EIOPA RFR data transformation. This solution involves developing VBA scripts that automatically process incoming EIOPA Excel files. Implementation typically requires creating a master template with embedded macros that handle the extraction and transformation process.

The key to successful macro implementation lies in robust error handling and version control. Start by creating a standardized template that maps EIOPA’s Excel structure to your required output format. Include validation checks for currency codes, time periods, and rate values. Consider implementing logging functionality to track processing steps and identify potential issues.

Remember to include error handling for common scenarios like missing sheets or changed structures. Consider using named ranges to make the solution more maintainable.

Python Scripting: Automation Meets Flexibility

Python scripting offers a more robust and scalable approach to EIOPA RFR data processing. Using libraries like pandas and openpyxl, you can create reliable data pipelines that handle both current and historical data processing needs.

Here’s a practical implementation approach:

1. Create a standardized configuration file defining EIOPA Excel structure mappings

2. Implement validation checks for data integrity

3. Build transformation logic using pandas DataFrame operations

4. Set up automated testing for different EIOPA file versions

Enterprise ETL Solution: Scale Meets Governance

For larger organizations, implementing an enterprise ETL solution provides the necessary scalability and governance features. Modern ETL tools offer pre-built connectors for Excel processing and can handle the complexities of EIOPA’s data structure.

Key implementation considerations include:

1. Setting up automated file ingestion processes

2. Implementing data quality rules and validation checks

3. Creating audit trails for regulatory compliance

4. Establishing error handling and notification systems

Consider tools like Informatica PowerCenter or Talend for implementation. These platforms offer visual development environments that simplify the creation of complex transformation logic while maintaining proper documentation and version control.

The Path to Automation: Benefits

Implementing automated EIOPA RFR data processing delivers significant benefits. Immediate benefits include reduced manual effort, fewer errors, and faster processing times. Long-term advantages encompass improved audit trails, better resource allocation, and enhanced ability to handle regulatory changes.

Taking the First Step

Begin your automation journey by assessing your current EIOPA RFR data processing workflow. Identify manual touchpoints and potential automation opportunities. Consider starting with a pilot project focusing on a specific currency or time period.

Remember, even the longest journey begins with a single step – or in this case, a single automated Excel file. Just don’t let your automation become self-aware and start trading on its own!

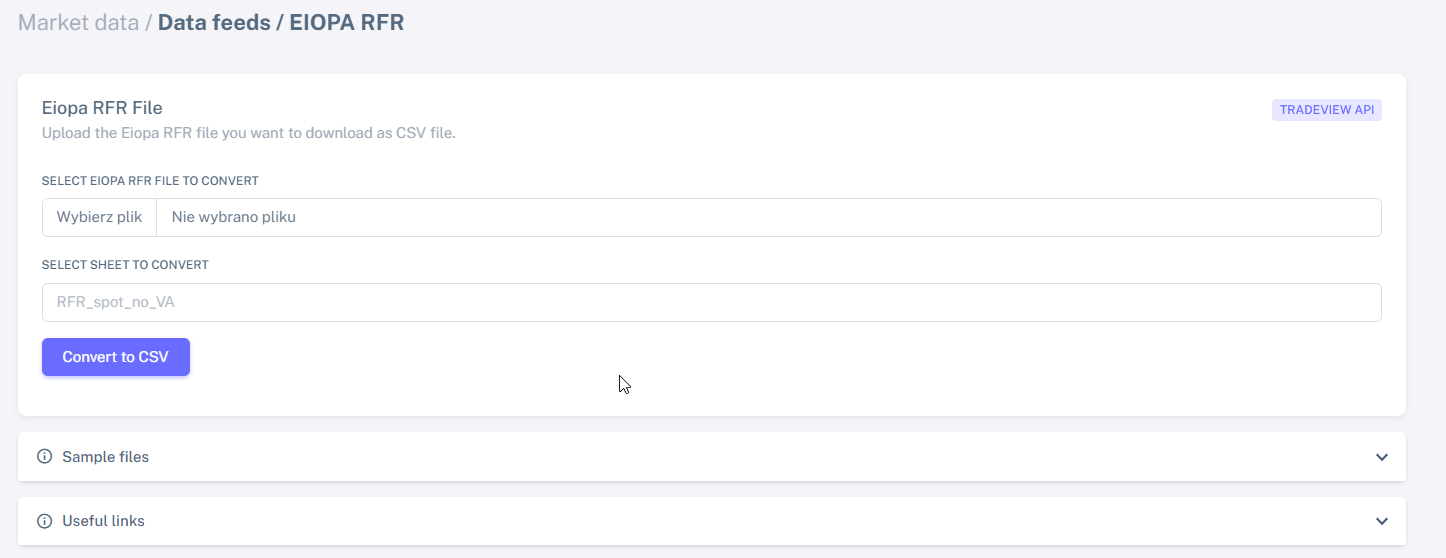

Ready to Automate Your EIOPA RFR Processing

Access our free EIOPA RFR Parser tool to experience automated data processing firsthand. Convert EIOPA Excel files to CSV or JSON format with just a few clicks. Don’t let manual data processing slow you down – start automating today.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Stefan Steinbauer on Unsplash