In today’s financial institutions, the lack of standardized Python implementations across trading, valuation, and reporting functions creates a costly technical debt crisis. As institutions migrate from legacy systems to Python-based solutions, the absence of unified programming standards threatens operational efficiency and regulatory compliance. This guide explores how enterprise financial code standardization transforms fragmented systems into cohesive, maintainable architectures.

The Hidden Cost of Financial System Fragmentation

Financial institutions struggle with fragmented Python implementations across their trading and risk departments. This fragmentation isn’t merely a technical inconvenience – it’s a strategic liability that impacts the bottom line. This fragmentation manifests in troubling ways: different versions of the Black-Scholes model, missed trading opportunities due to incompatible date rollover calculations, capital calculations varying across departments due to inconsistent yield curve methods.

The problem is becoming more urgent with the rise of algorithmic trading and stricter regulatory requirements. Modern financial systems demand both millisecond-level execution and complete calculation transparency. As automated risk management becomes the norm, inconsistent implementations create compounding inefficiencies that threaten operational stability.

As one CTO remarked, “We’re not just speaking different dialects anymore; we’re building a Tower of Babel with Python libraries.” And just like the biblical tower, this one’s bound to fall without proper architectural planning.

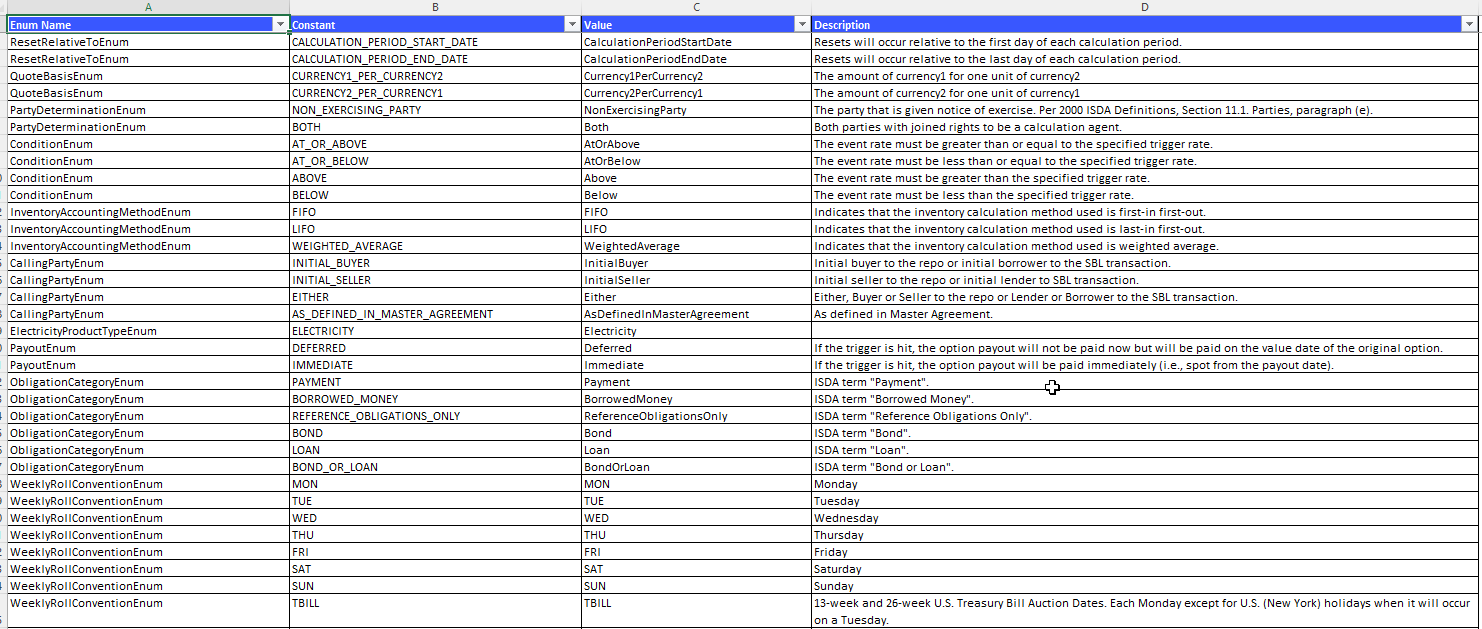

Enums: The Foundation of Financial Data Standardization

Financial enums emerge as a powerful solution to the standardization crisis, providing type safety and eliminating the string literal chaos that plagues many trading systems. Think of enums as the financial programmer’s Rosetta Stone – they translate complex financial concepts into a universally understood language across your organization.

When implementing financial enums:

- Use descriptive names that align with industry terminology

- Include validation logic within enum methods

- Provide clear conversion methods for external system integration

- Maintain backward compatibility during migration

- Document business rules and assumptions in enum definitions

- Include comprehensive test coverage for enum behavior

This standardized approach creates a maintainable, type-safe foundation for financial systems while preserving flexibility for future expansion. The result is a robust financial type system that eliminates common sources of error while improving code maintainability and developer productivity.

Quantifiable Benefits of Standardization

The implementation of unified financial programming standards delivers measurable improvements The implementation of unified financial programming standards delivers significant improvements across key operational areas. In terms of development efficiency, teams experience dramatically reduced code review cycles as reviewers work with consistent patterns across the codebase. Cross-team collaboration becomes smoother with fewer integration conflicts, while new developers become productive more quickly by learning a single set of standardized conventions.

From a risk management perspective, standardization nearly eliminates calculation inconsistencies across systems and enables streamlined risk aggregation processes across trading desks. This consistency leads to a marked reduction in regulatory reporting errors through uniform calculation methods.

The operational impact is equally substantial. Organizations see lower maintenance costs through simplified codebase management, while new features can be developed more rapidly using reusable standardized components. The consistent implementation patterns also result in fewer emergency fixes, reducing the operational burden on development teams and improving system reliability.

Taking Action: Your Path to Standardization

Begin your standardization journey by auditing your current Python implementations across trading and risk systems. Document inconsistencies in naming conventions, calculation methods, and data handling approaches. Download our comprehensive Financial Enum Starter Kit, which includes pre-built enums for common financial calculations and a migration guide.

Remember, as the ancient programmers used to say: “A thousand monkeys at a thousand keyboards might eventually write Shakespeare, but they’ll never agree on how to calculate year fractions without proper enums.”

Download our comprehensive Financial Enum Starter Kit

Ready to standardize your Python workflows? Download our comprehensive enum reference collection, containing over 300 standardized financial conventions, including business day rules, period types, and quote bases. Don’t let inconsistent conventions create unnecessary risks in your operations. Download now and start implementing these standards today.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Chris Czermak on Unsplash