Financial institutions process millions of date-dependent transactions daily, yet inconsistent date formats remain one of the most pervasive and costly data quality issues. Financial data normalization techniques can transform this chaos into standardized formats, eliminating calculation errors and enabling automation. The solution lies not in working harder, but in implementing systematic date standardization approaches.

The Hidden Cost of Date Format Inconsistencies in Financial Operations

Financial analysts report spending a lot of their time managing date format inconsistencies before performing critical calculations. A common scenario: Treasury receives loan data with European-format dates (DD/MM/YYYY), accounting systems use American formats (MM/DD/YYYY), while payment systems adhere to ISO standards (YYYY-MM-DD). Adding to this complexity, some systems accept named date formats like “13th of February” or “February 13,” which require additional parsing logic. Even more problematic are invalid dates that slip through validation – such as “31st of June” or “31st of September” – which don’t exist in the calendar but may be accepted by systems lacking proper validation. This inconsistency creates a perfect storm for financial data quality issues.

These cross-department data standardization problems create friction between teams, with finance departments frequently returning data to originating units for correction. This cycle creates project delays, increases operational costs, and heightens compliance risks. Even sophisticated automation initiatives stumble against the seemingly simple barrier of inconsistent date formats. Your organization’s digital transformation might be failing not because of complex technology, but because nobody knows if 02/03/2024 means February 3rd or March 2nd. Date formats: turning brilliant financial analysts into calendar detectives since spreadsheets were invented.

Preventing Incorrect Date Formats at Source

Addressing financial data inconsistency challenges requires a two-pronged approach: prevention at source and standardization of existing data.

For prevention, implementing strict data validation in common input sources is essential. Excel, despite being the financial industry’s workhorse, remains a primary source of date formatting errors. Implementing data validation rules through Data → Data Validation can restrict users to specific date formats. More sophisticated organizations implement custom VBA macros that automatically convert inputs to standardized formats regardless of how they’re entered.

Google Sheets offers similar validation capabilities through Data → Data Validation, with the added benefit of cloud-based consistency.

Forward-thinking financial institutions are implementing ISO 8601 date format implementation across their finance systems. This international standard (YYYY-MM-DD) eliminates ambiguity and supports natural sorting in databases.

Standardizing Existing Date Formats

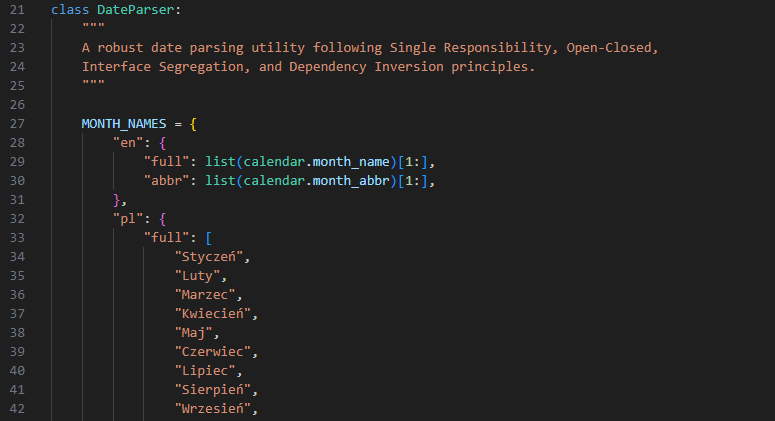

When prevention fails and you’re faced with datasets containing multiple date formats, automated date format standardization tools become essential. Python has emerged as the preferred tool for financial data engineers tackling this challenge.

Python’s datetime module, combined with powerful libraries like pandas and arrow or whenever, provides flexible parsing capabilities for virtually any date format. A typical approach involves:

1. Identifying the various date formats in your dataset

2. Using pandas’ to_datetime() function with format detection

3. Standardizing outputs to ISO 8601 or your institution’s preferred format

4. Validating results against business rules

Benefits of Standardized Date Formats

The immediate benefits include dramatic reductions in manual data preparation. Financial analysts reclaim hours previously spent reformatting dates, allowing them to focus on value-added analysis. Calculation errors from misinterpreted dates virtually disappear, improving the accuracy of interest accruals, payment schedules, and period-based analyses.

Long-term benefits prove even more substantial. Automation initiatives previously stalled by date inconsistencies can proceed, delivering operational efficiencies across departments. Regulatory reporting becomes more reliable as date-dependent calculations maintain consistency across reporting periods. Cross-functional collaboration improves as departments share a common date language, eliminating a significant source of friction.

Perhaps most importantly, standardized dates enable advanced analytics. Time-series analysis, predictive modeling, and AI applications require consistent temporal data. Organizations that solve the date standardization challenge position themselves to leverage these technologies for competitive advantage.

Next Steps: Implementing Your Date Standardization Strategy

Begin by conducting a date format audit across your key financial systems. Identify the various formats in use and their sources. Then develop a standardization policy that specifies your organization’s preferred date format and implementation approach. For most financial institutions, adopting ISO 8601 (YYYY-MM-DD) provides the clearest path to consistency.

Next, implement controls at data entry points while developing standardization processes for existing data. Our downloadable Python script provides a flexible framework for converting various date formats to your standardized format, handling even the most problematic cases.

Finally, embed date standardization within your broader data governance program. This ensures sustainability beyond the initial implementation. Remember, in financial data, dates are like birthdays – get them wrong and someone’s going to be very unhappy about the calculation results.

## Take Control of Your Date Formats Today

Download our free Python Date Standardization Toolkit and eliminate the costly errors caused by inconsistent date formats. This proven solution has helped financial institutions reduce processing time by up to 40% while virtually eliminating date-related calculation errors. Don’t let ambiguous dates undermine your financial operations for another quarter – implement standardized date formatting today.

Download our free Python Date Standardization Toolkit

Take Control of Your Date Formats Today. Download our free Python Date Standardization Toolkit and eliminate the costly errors caused by inconsistent date formats. Don’t let ambiguous dates undermine your financial operations for another quarter – implement standardized date formatting today.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Emma Harrisova on Unsplash