Financial departments across industries are drowning in a sea of disconnected data sources, creating a perfect storm of inefficiency and error-prone reporting. Our innovative managed ETL solution tackles fragmented financial reporting systems head-on, streamlining financial data integration across platforms without requiring technical expertise from your team. This approach transforms how organizations handle cross-system financial data consolidation, turning a traditional pain point into a competitive advantage.

The Growing Crisis of Financial Data Fragmentation

When Financial Data Silos Become Financial Quicksand

Today’s financial departments find themselves trapped between legacy systems and modern cloud applications, creating a complex web of incompatible data formats. ERP systems store transaction data in proprietary structures while CRM platforms house revenue forecasts in entirely different schemas. Meanwhile, regional offices maintain localized spreadsheets with varying currencies and accounting practices. This fragmentation forces highly-skilled financial professionals to spend up to 70% of their time on manual data wrangling rather than strategic analysis.

The consequences extend far beyond mere inconvenience. For public companies, this elevates compliance risks. For private organizations, it means strategic decisions are often based on outdated or incomplete information.

CFOs particularly feel this pain during board meetings, where presenting consolidated financial projections requires weeks of preparation. Financial analysts struggle to produce timely budget-versus-actual comparisons when data lives in disconnected systems. Controllers find month-end close procedures extending by days as they manually reconcile transactions across subsidiaries. Treasury managers, unable to trust fragmented cash flow data, compensate by maintaining excessive cash reserves that could otherwise be deployed for growth.

The complexity scales with organizational growth. Each new acquisition, market expansion, or system implementation adds another layer to the data integration challenge. When your financial data is more fragmented than your aunt’s collection of inspirational refrigerator magnets, you know it’s time for a change.

A Managed Approach to Financial Data Integration

Bridging the Cross-System Financial Data Consolidation Gap

Traditional approaches to solving data fragmentation typically involve either expensive system replacements or complex custom integration projects that strain IT resources. Our managed ETL solution takes a fundamentally different approach by providing a complete data integration ecosystem that requires no technical implementation from your team.

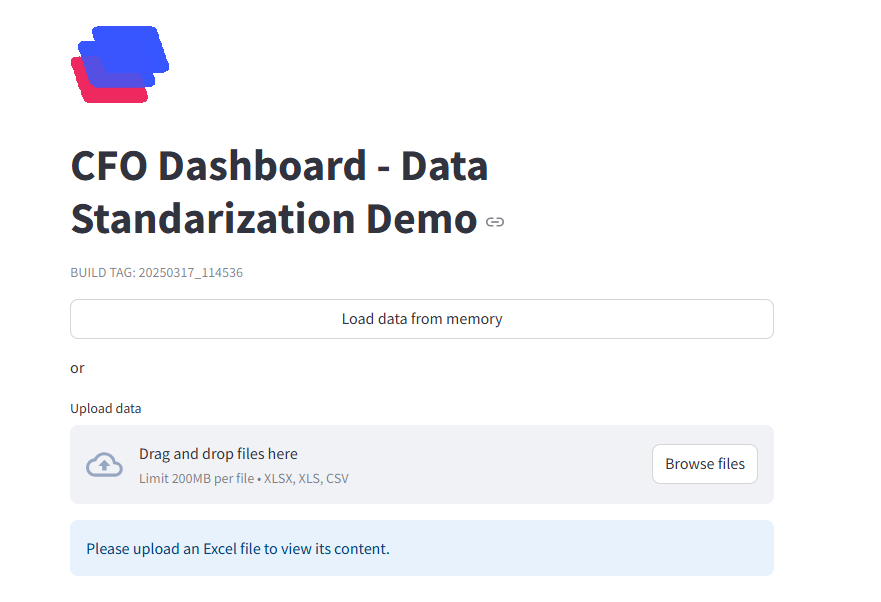

The solution combines powerful enterprise-grade data processing with an intuitive user interface accessible to financial professionals. Users interact with a straightforward drag-and-drop interface where they can submit multiple files in any format—Excel spreadsheets, CSV exports, database dumps, or API connections. Behind this simple interface runs sophisticated data transformation logic custom-configured to your organization’s unique financial data landscape.

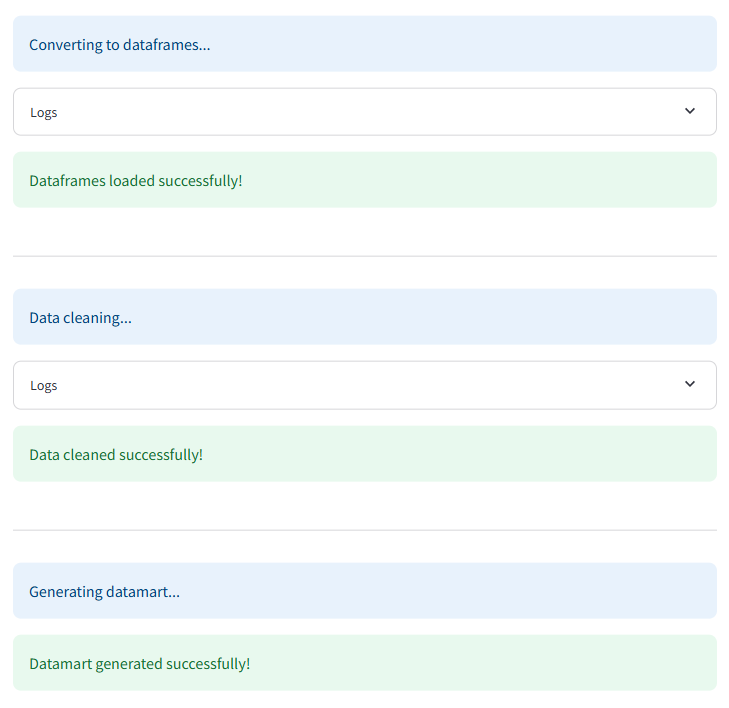

Each data processing job executes a carefully orchestrated sequence of operations. First, the system applies specialized cleaning strategies to each incoming data source, handling inconsistencies in formats, currencies, accounting methods, and naming conventions. Next, the consolidation engine merges these cleaned datasets according to defined business rules, creating a unified financial data repository.

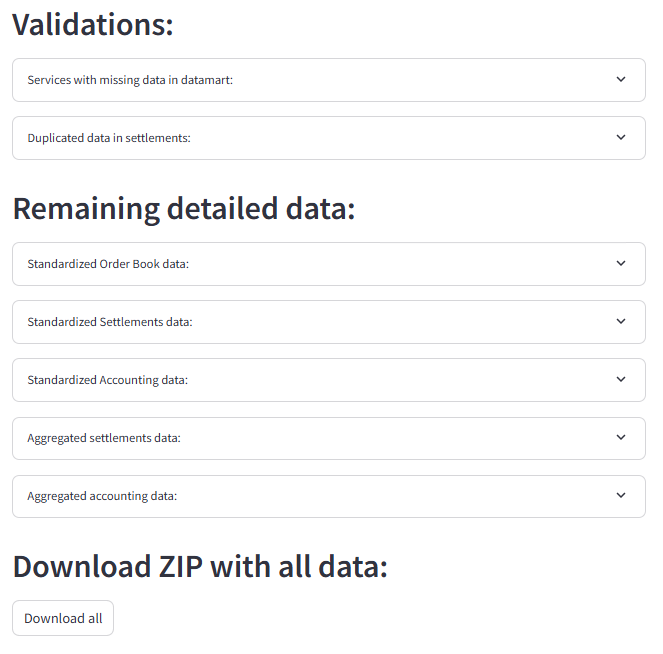

Transparency remains central to the process. Financial users receive detailed logs for each operation, maintaining visibility into transformations without needing to understand the underlying code. When exceptions occur—such as missing source files or validation failures—the system proactively alerts users with actionable guidance rather than cryptic error messages.

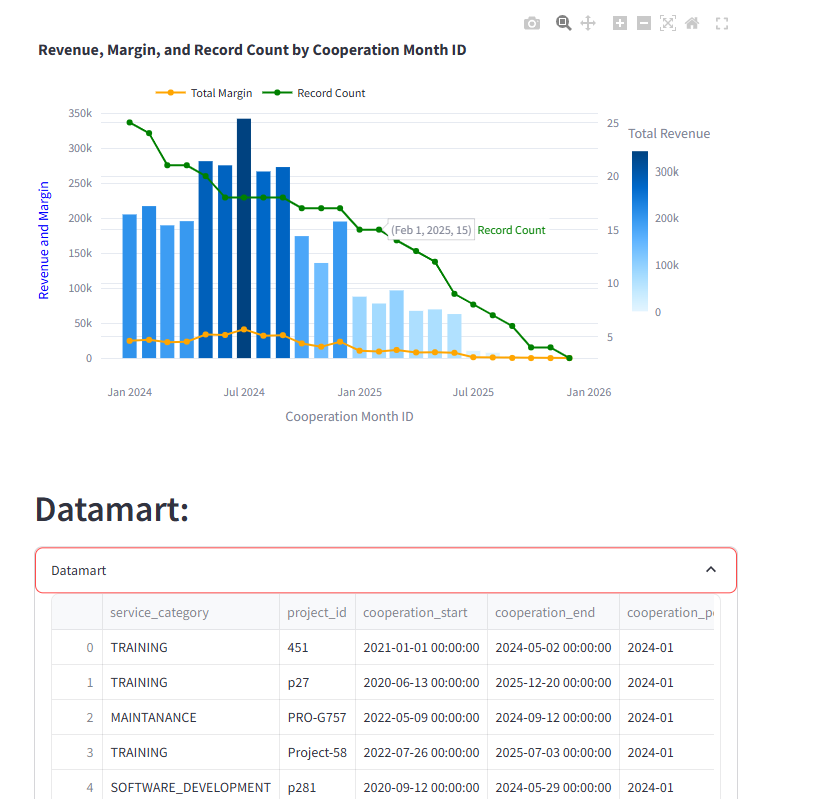

Once processing completes, users gain immediate access to visualization dashboards highlighting key metrics and patterns in the newly consolidated data. The system enables download of cleaned, analysis-ready data marts in formats compatible with existing financial analysis tools. For audit and compliance purposes, validation datasets document the transformation journey from raw inputs to final outputs.

Security underpins the entire solution through HTTPS encryption, secure authentication, and comprehensive access controls that maintain proper data governance. The fully managed infrastructure eliminates the need for internal maintenance while ensuring enterprise-grade reliability.

The Business Impact of Unified Financial Data

Breaking down financial data silos delivers both immediate operational improvements and long-term strategic advantages. Organizations implementing integrated financial data management solutions report reducing report generation time by an average of 68%. This translates to thousands of recovered hours annually that financial professionals can redirect toward value-adding analysis.

Decision quality improves dramatically when operating from a single source of financial truth. This improved forecasting precision enables more effective capital allocation, inventory management, and resource planning.

Risk management capabilities strengthen when financial data flows seamlessly across systems. Month-end close cycles typically contract by 2-3 days, providing earlier visibility into financial performance. Audit trails become comprehensive and automatic, simplifying compliance procedures and reducing preparation time for financial reviews.

Perhaps most significantly, integrated financial data environments enable scenario modeling and simulation capabilities previously unattainable in fragmented ecosystems. Financial planning teams can rapidly test multiple business assumptions without weeks of manual data preparation, leading to more agile strategic responses to market changes.

The technology implementation itself presents minimal disruption since the managed ETL approach requires no rip-and-replace of existing systems. Financial departments maintain their familiar tools while eliminating the manual integration burden that previously consumed their time.

Experience the Transformation

The fastest way to understand the impact of unified financial data management is to see it in action. The demo showcases both the user experience and the resulting data quality improvements. Financial analysts can follow the guided walkthrough to understand how the solution would integrate into their specific workflows.

Moving forward with implementation typically begins with a focused proof-of-concept addressing your most pressing financial data integration challenge. This approach delivers immediate value while establishing the foundation for expanding to additional data sources and use cases. By starting with a defined problem—perhaps streamlining quarter-end reporting or improving cash flow forecasting—teams can measure concrete benefits before scaling the solution.

Remember, when your financial data finally comes together, it’s like watching that satisfying moment when all Tetris pieces click perfectly into place – except instead of disappearing, your insights multiply.

Transform Your Financial Data Ecosystem Today

Contact our financial data integration team now to schedule your personalized demo and receive a complimentary assessment of your current financial data architecture. Don’t let another reporting cycle disappear into manual data wrangling – the competitive disadvantage grows with each delayed implementation. Discover how quickly your organization can achieve the benefits of unified financial data management.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Pedro Lastra on Unsplash