Financial institutions face a silent threat in their risk management operations: model deterioration that gradually erodes decision quality. As market conditions evolve, even meticulously developed credit models begin to drift, leading to increasingly inaccurate lending decisions. Our automated risk model monitoring solution provides continuous oversight of model performance, detecting drift patterns before they impact your bottom line.

The Growing Challenge of Credit Risk Model Drift in Banking

In today’s volatile economic environment, credit risk models that performed exceptionally during development often deteriorate silently over time. The costs of undetected model drift extend beyond immediate credit losses. Regulatory scrutiny intensifies as examiners increasingly focus on continuous model monitoring capabilities, frequently citing institutions for inadequate drift detection processes. Meanwhile, model risk management teams spend countless hours manually gathering validation evidence from disparate systems, a process that’s not only inefficient but also prone to dangerous oversight.

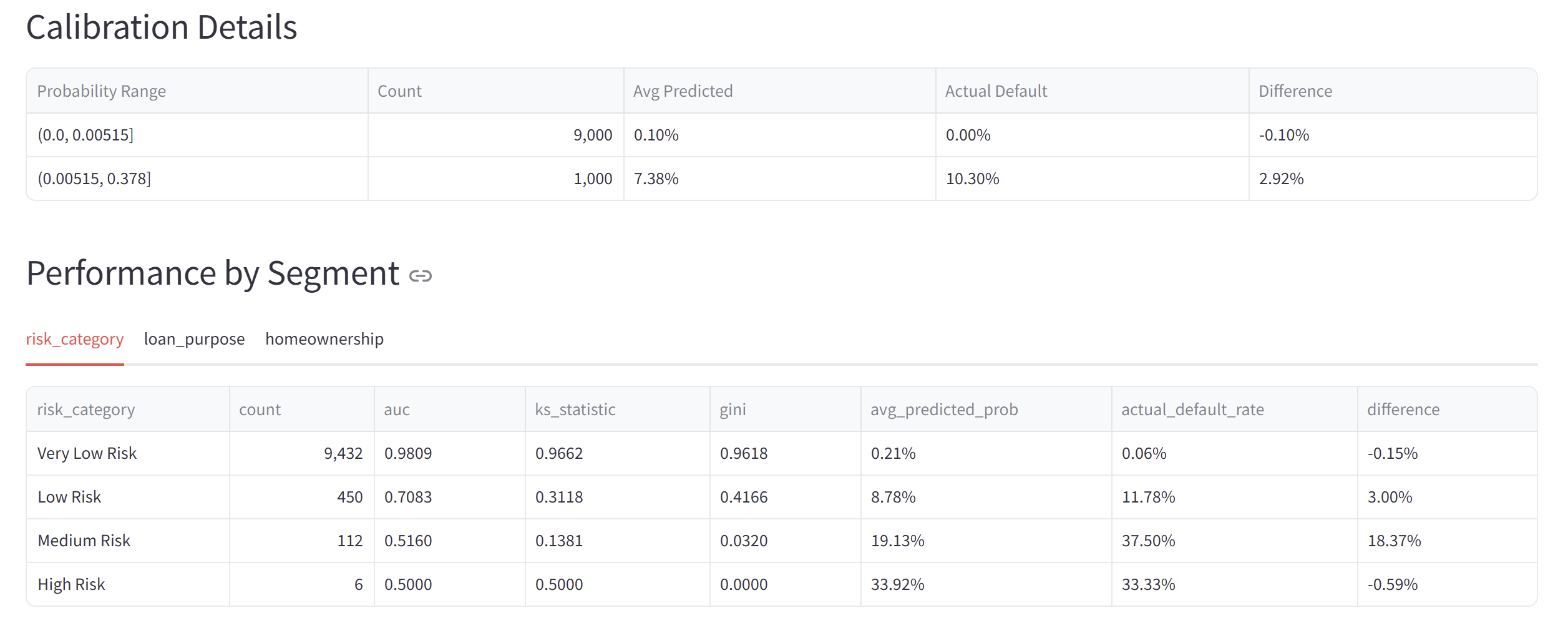

Cross-segment performance visibility presents another critical challenge. A model might maintain acceptable overall performance while significantly underperforming in specific customer segments, potentially leading to fair lending concerns that remain hidden in aggregate statistics. When manual monitoring consumes up to 20 hours per analyst weekly, these nuanced performance issues often go undetected until they trigger regulatory attention or substantial losses.

Your model might be silently ghosting you while still sending performance love letters to your dashboard.

Implementing a Comprehensive Model Monitoring Solution

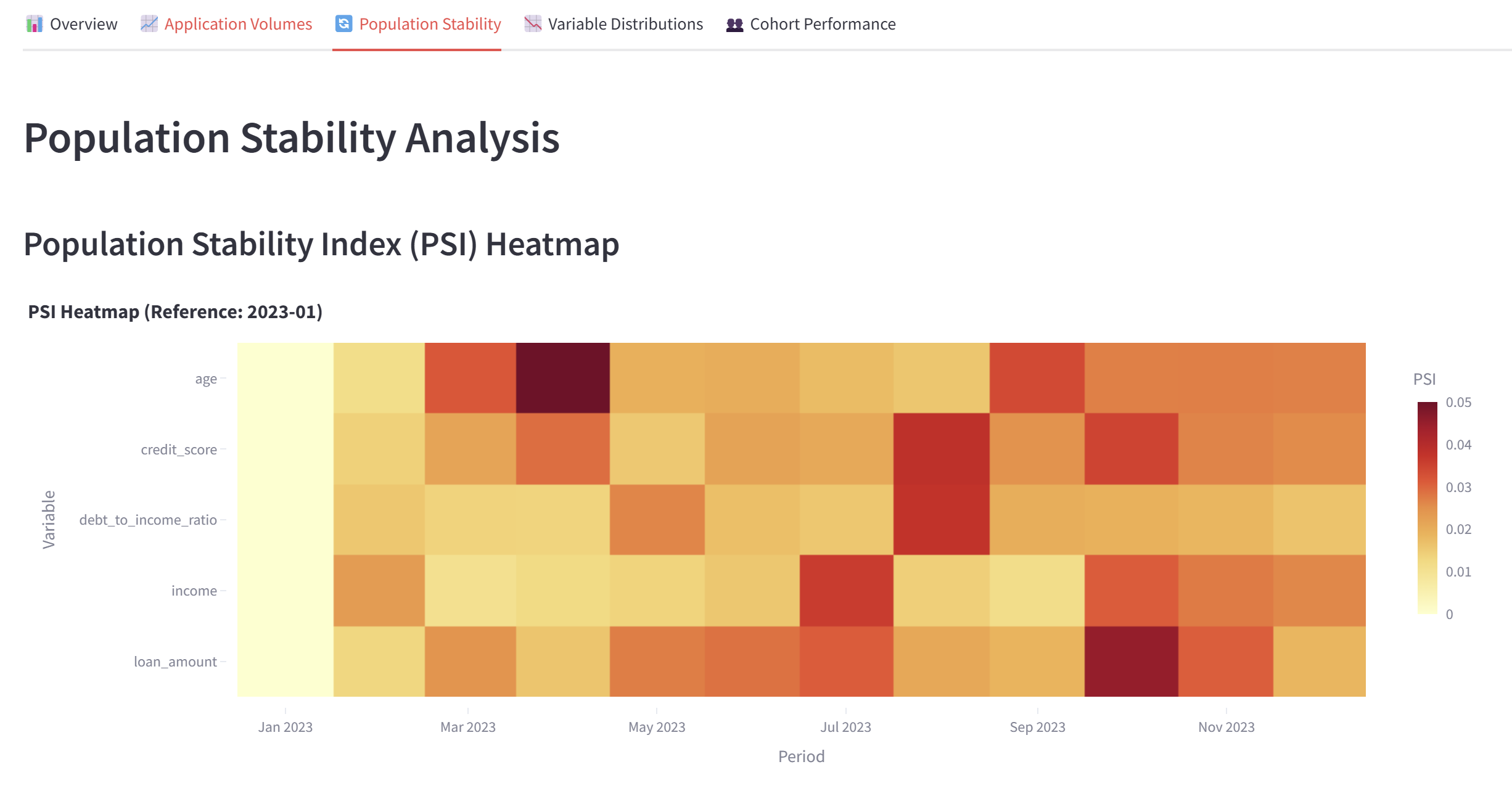

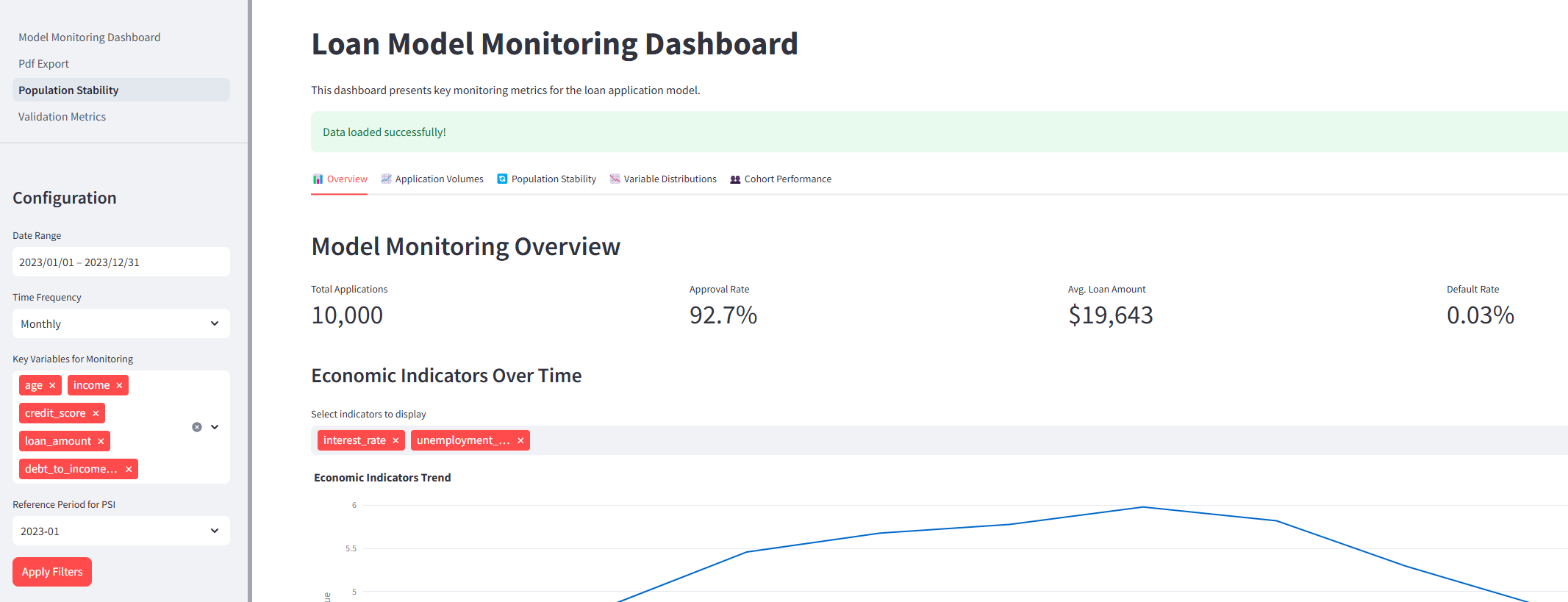

Our demonstration showcases a model risk management solution that addresses these challenges through automated, continuous monitoring capabilities. The system implements PSI (Population Stability Index) monitoring pipelines that track shifts in both application volumes and approval rates over time, providing early warning indicators of environmental changes affecting model performance.

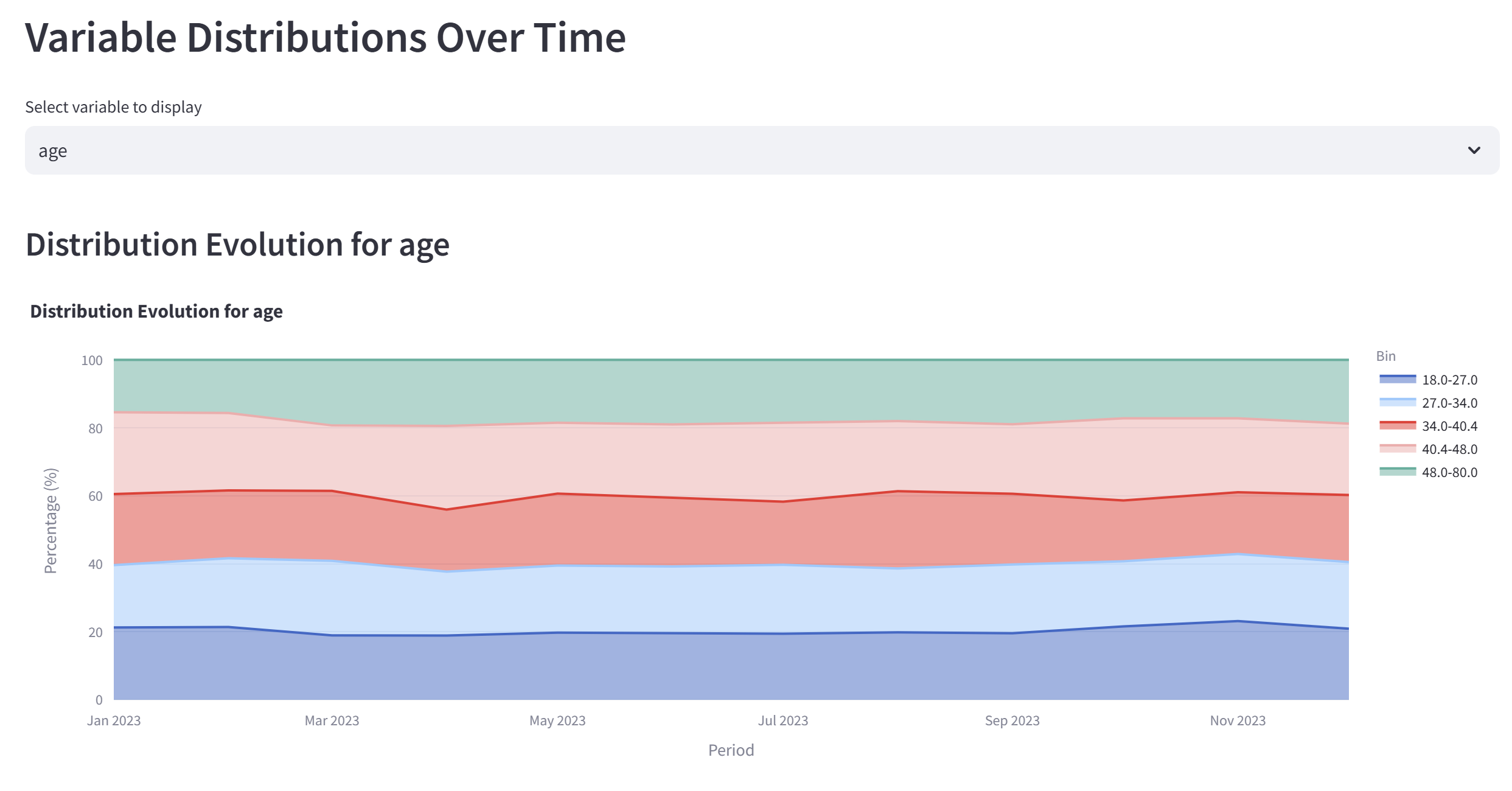

The solution offers real-time detection of feature drift through continuous distribution analysis of key model variables. By monitoring how variable distributions change compared to development samples, the system can identify when models operate outside their design parameters. This approach enables risk teams to detect when models begin making decisions based on data patterns they weren’t calibrated to handle.

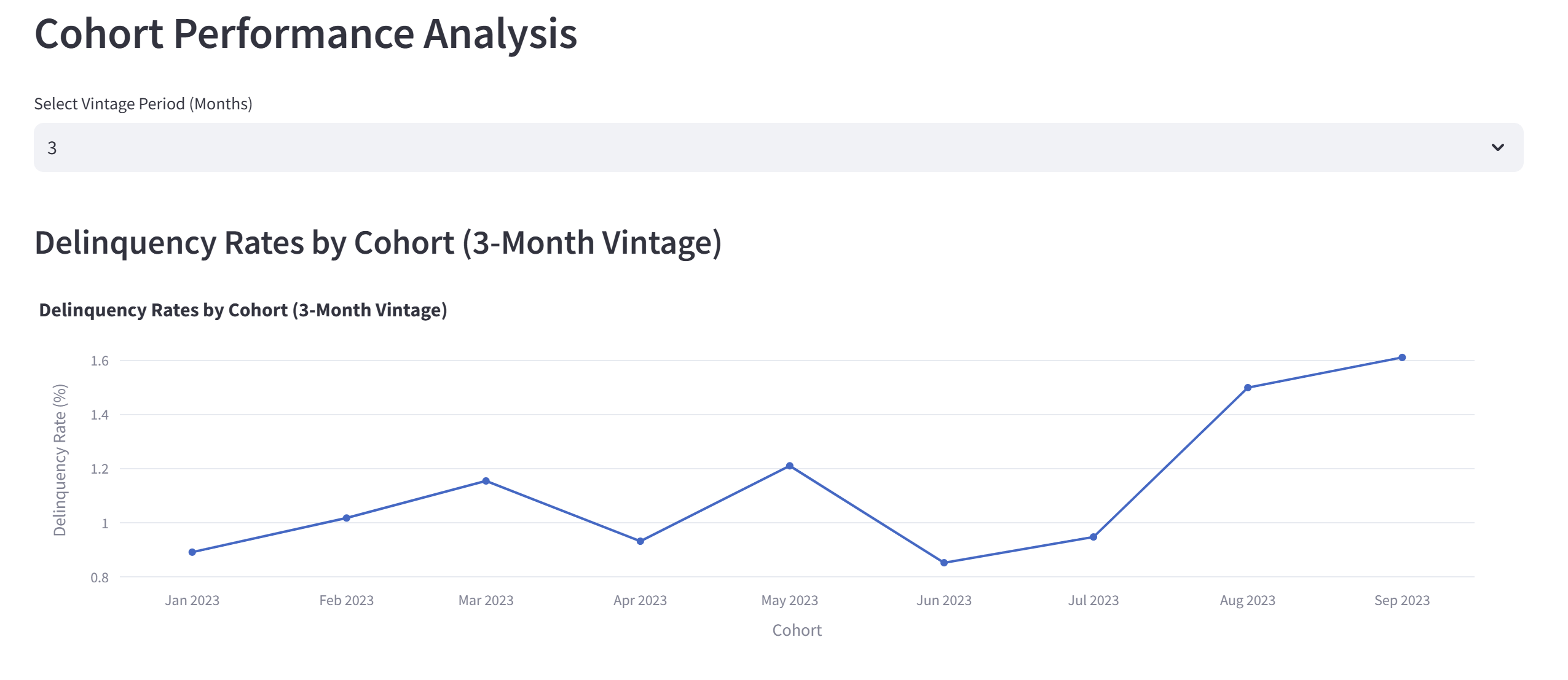

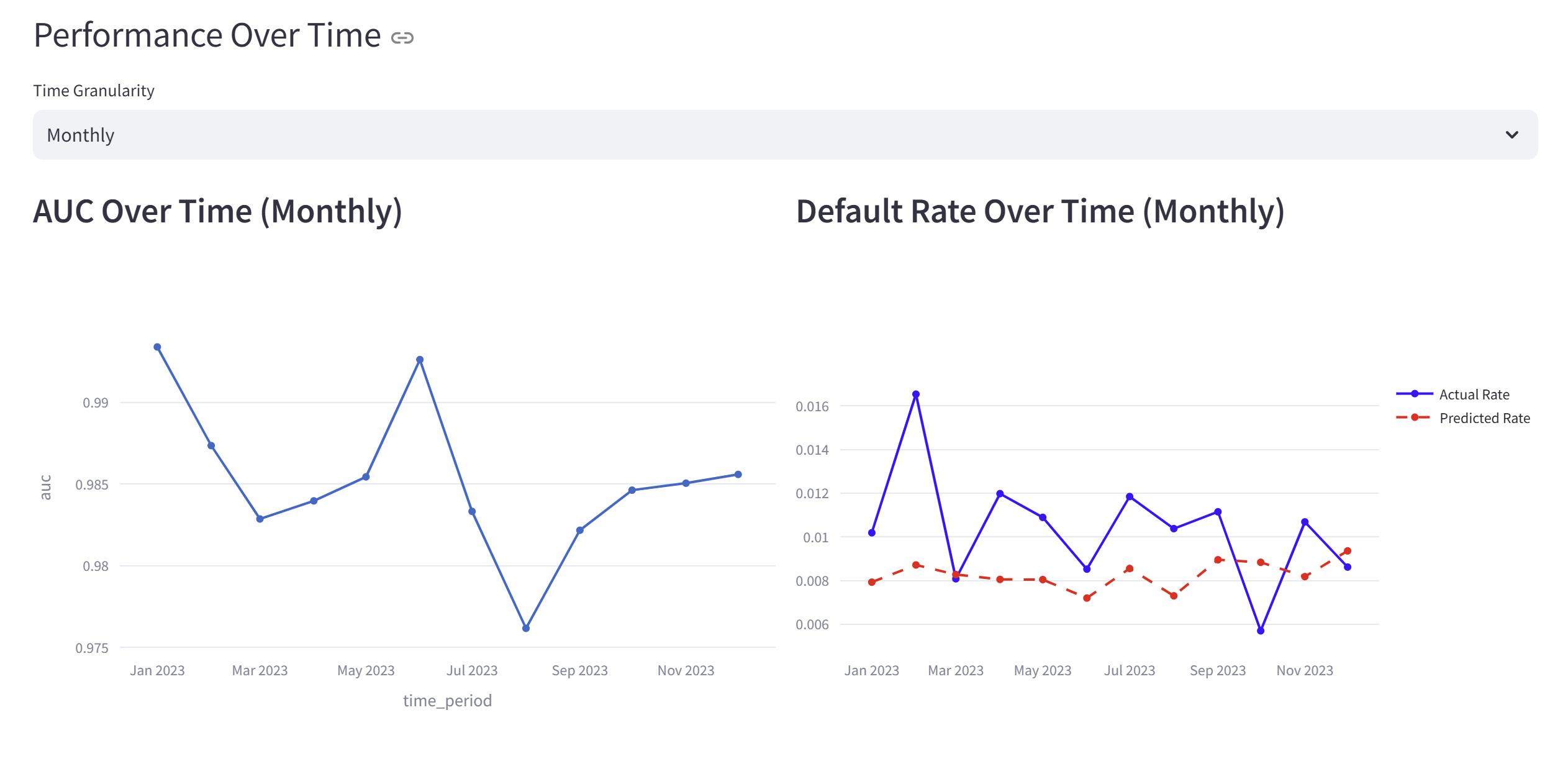

Beyond stability monitoring, the solution includes cohort performance analysis reporting that automatically tracks discrimination metrics (AUC, KS, Gini) and calibration assessments across different time periods and customer segments. This segment-specific monitoring provides critical visibility into how models perform across diverse borrower populations, helping institutions detect both performance deterioration and potential fair lending concerns simultaneously.

Decision threshold optimization tools within the system allow risk managers to simulate different approval thresholds and observe the projected impact on approval rates, expected losses, and revenue. This capability enables more responsive policy adjustments as risk conditions change, balancing loss avoidance with growth opportunities.

Benefits of Automated Model Monitoring

Implementing automated credit model performance tracking delivers substantial benefits across multiple dimensions. Operational efficiency gains are significant. Institutions transitioning from manual to automated monitoring report 70-80% reductions in time spent on routine validation tasks, freeing highly skilled analysts for more strategic work.

Regulatory benefits extend beyond avoiding potential fines. Examiners increasingly evaluate model risk management maturity as part of their overall risk assessment, with documented continuous monitoring capabilities frequently cited as a distinguishing factor between satisfactory and strong ratings. These ratings increasingly influence capital requirements and growth restrictions, creating long-term strategic advantages for institutions with robust monitoring practices.

Perhaps most importantly, sophisticated monitoring enables more confident decision-making. With clearer visibility into model performance, institutions can optimize decision thresholds more precisely, reducing the “uncertainty tax” of overly conservative lending policies implemented to compensate for limited model performance visibility.

Next Steps in Your Model Monitoring Journey

Experiencing our demonstration represents the first step toward transforming your model risk management capabilities. After reviewing the demo, schedule a consultation with our team to discuss how these capabilities would integrate with your existing systems and processes. We’ll help you develop an implementation roadmap customized to your institution’s specific model ecosystem and risk management priorities.

Remember, your models may be drifting away like teenagers at the mall – it’s time to install that parental tracking app.

Ready to Transform Your Model Risk Management?

Contact us today to schedule a personalized demonstration tailored to your institution’s model portfolio. Don’t wait for regulatory findings or unexpected losses to modernize your monitoring capabilities. Our team of former bank risk officers and model validation experts can help you implement a solution within 60 days.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Andreas Brücker on Unsplash