The Hidden Cost of Fragmented Financial Data

Financial institutions today face an unprecedented challenge in managing their loan portfolios. Despite technological advances in origination and servicing, most banks and lenders continue to struggle with fragmented visibility into portfolio performance. This disconnected view happens because critical loan data remains trapped in departmental silos, legacy systems, and incompatible databases. Risk managers, collections teams, and financial analysts spend countless hours manually consolidating data from disparate sources, often resulting in delayed insights when timely action is most needed. By the time portfolio reports reach decision-makers, the opportunity to proactively address emerging risks has often passed.

The manual reporting burden has become the financial equivalent of using a typewriter in the age of artificial intelligence. Your data deserves better—and so does your weekend.

Transforming Loan Data into Actionable Intelligence

Our loan portfolio monitoring dashboard addresses these critical challenges by automating loan data consolidation across your entire lending ecosystem. This comprehensive lending analytics platform seamlessly integrates data from multiple origination channels, core banking systems, and collection platforms to provide a unified view of portfolio performance.

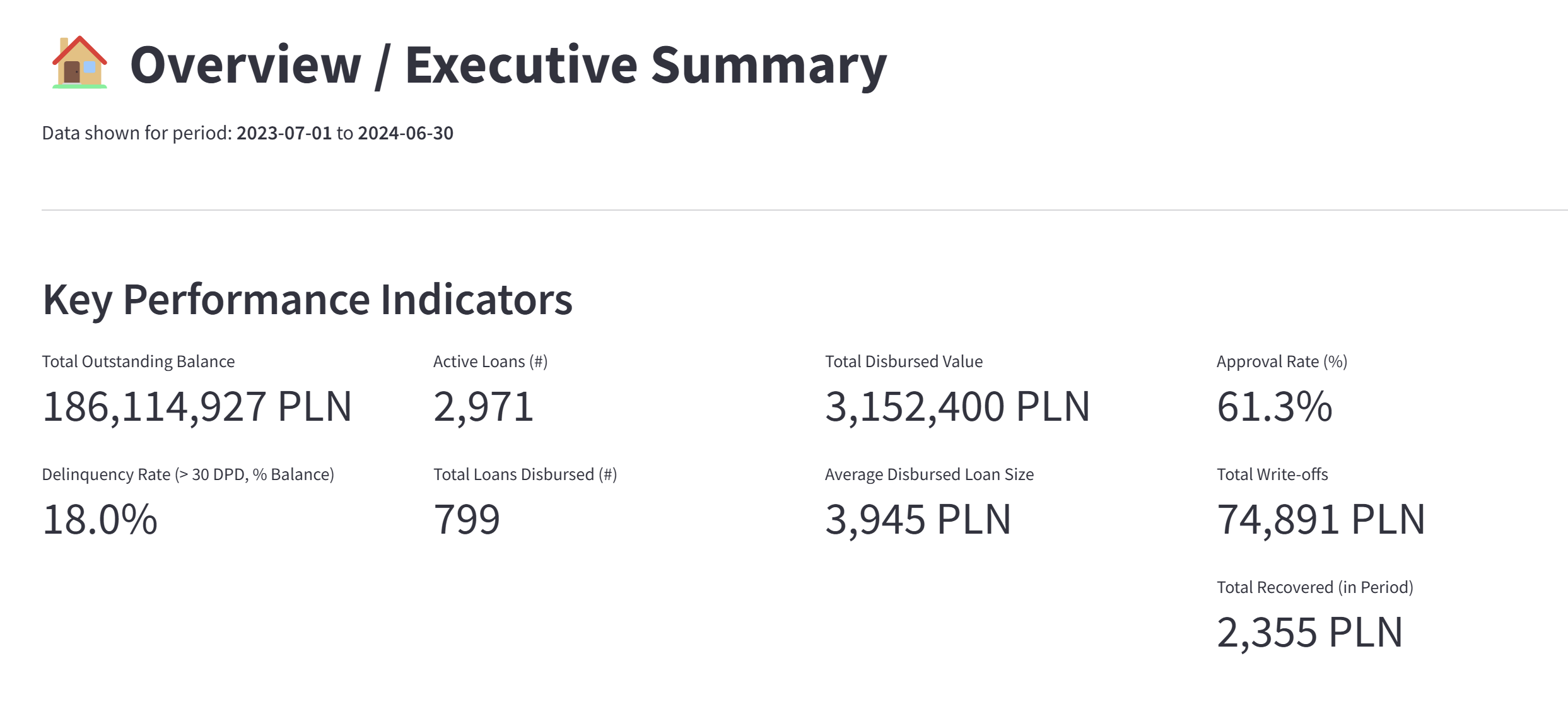

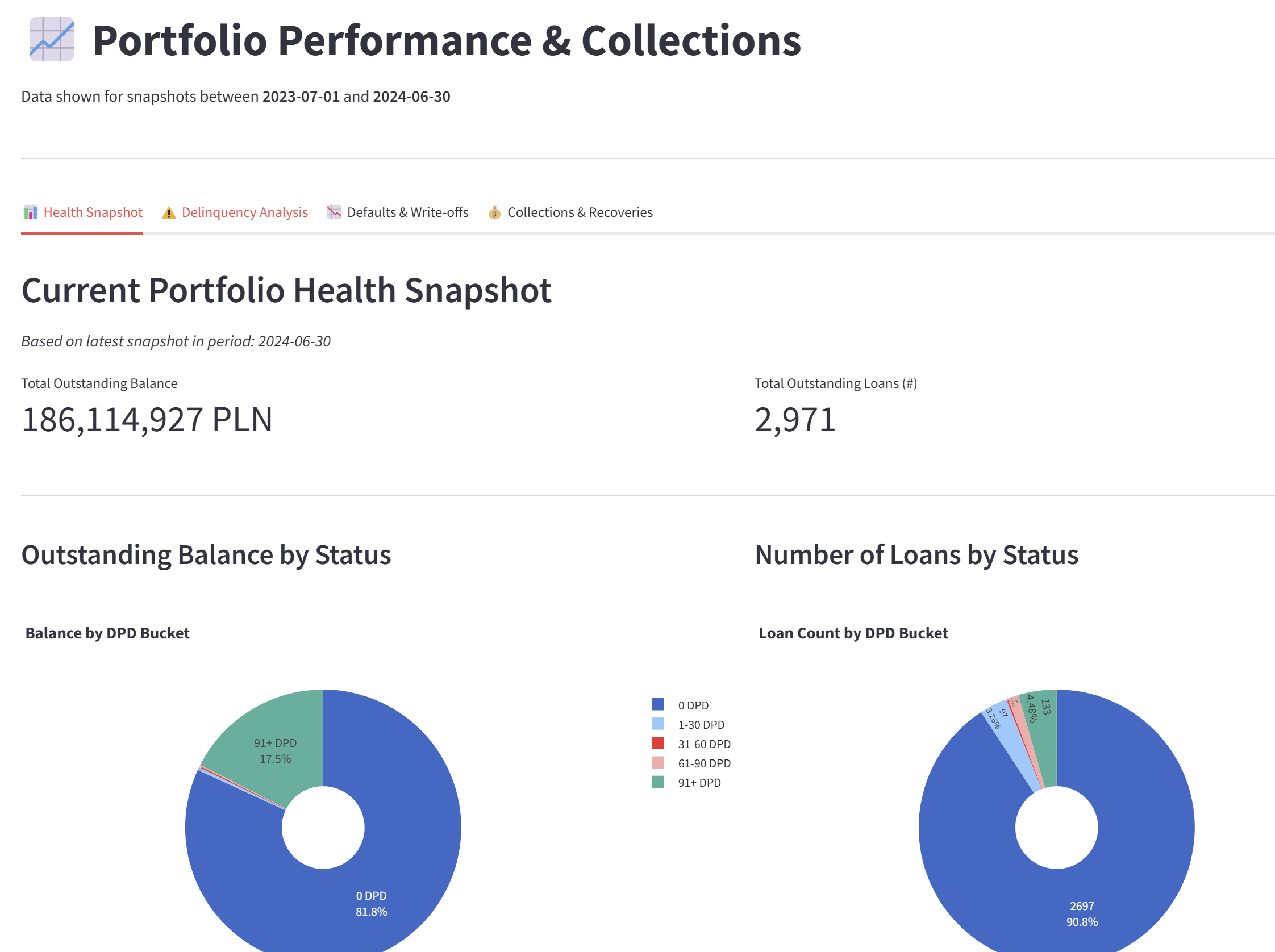

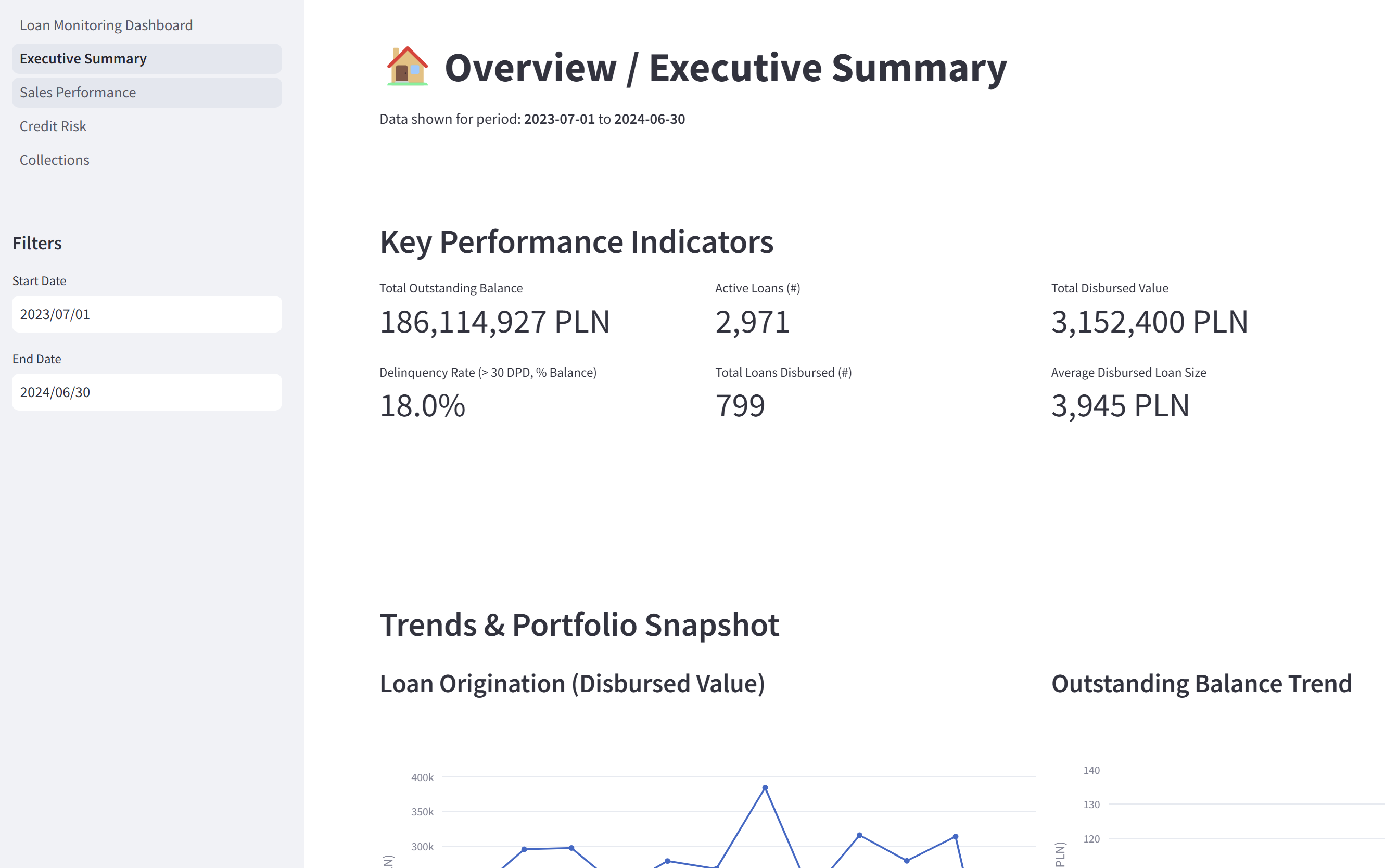

The solution’s executive summary dashboard delivers instant visibility into key performance indicators including total outstanding balance, active loan count, disbursed value metrics, and crucial risk indicators like 30+ day delinquency rates. Advanced trend visualization components track origination volumes, balance trends, and portfolio status snapshots, enabling executives to monitor overall portfolio health at a glance.

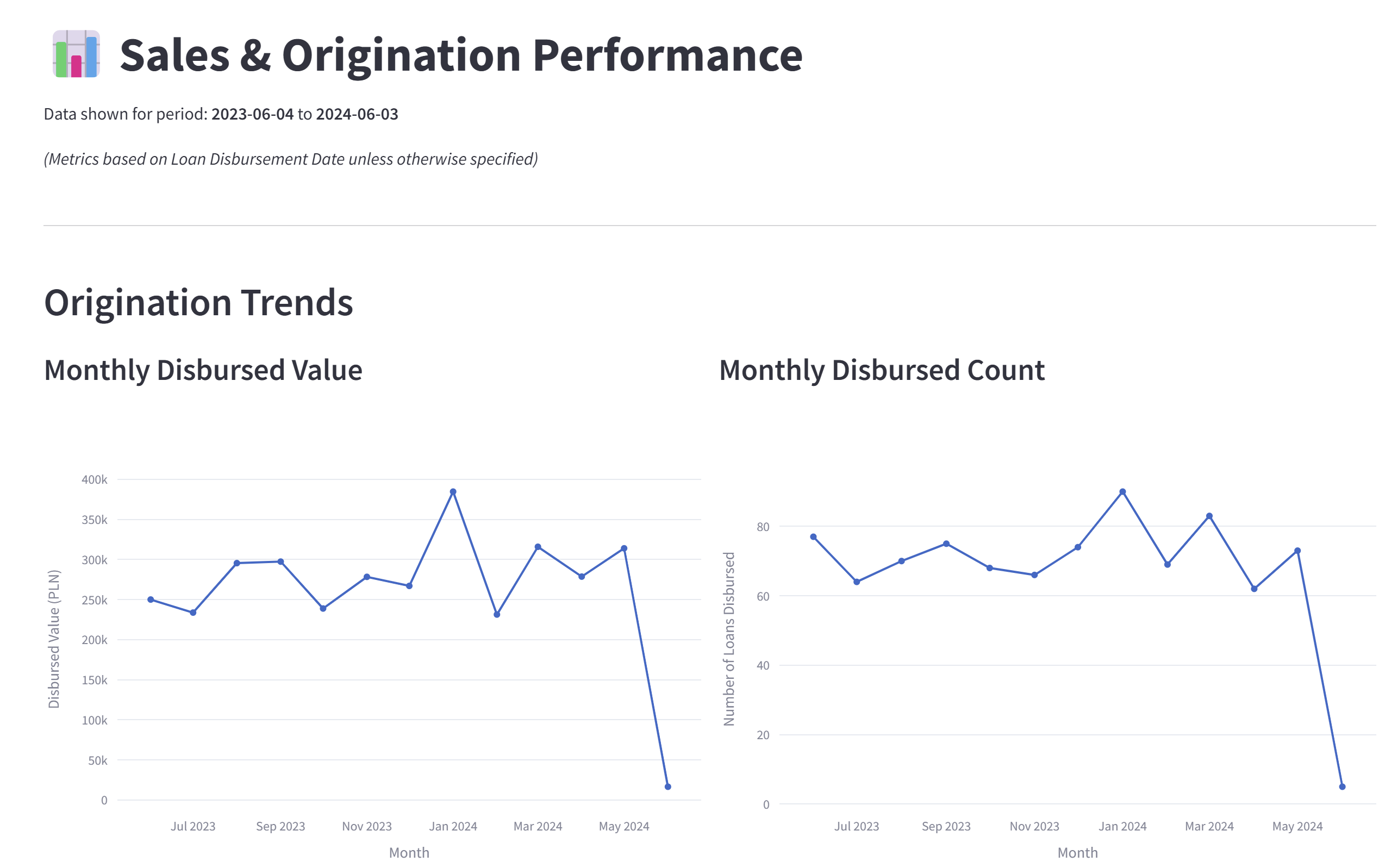

The sales and origination performance module offers granular visibility into monthly disbursement trends, average loan size fluctuations, and comparative channel performance. Product performance matrices help identify which lending products deliver optimal returns while regional heat maps highlight geographic performance variations. The customer acquisition analytics engine distinguishes between new and returning borrowers, enabling targeted retention strategies.

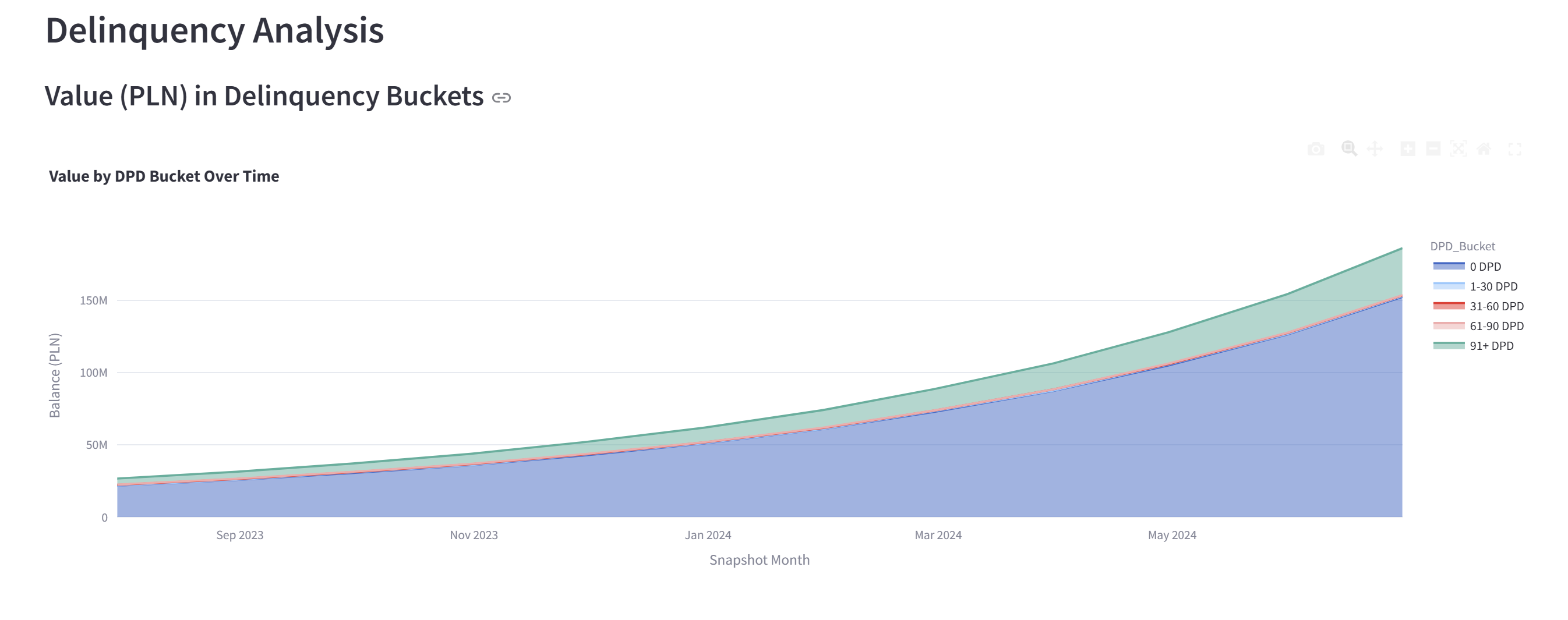

For credit and risk teams, the underwriting analytics module provides comprehensive application funnel visualization, approval trend tracking, and rejection analysis capabilities. Portfolio quality monitoring components include vintage curve analysis and early warning indicators configured to identify concerning trends before they escalate. The system’s predictive risk scoring algorithms leverage machine learning to flag potentially problematic loans earlier in their lifecycle.

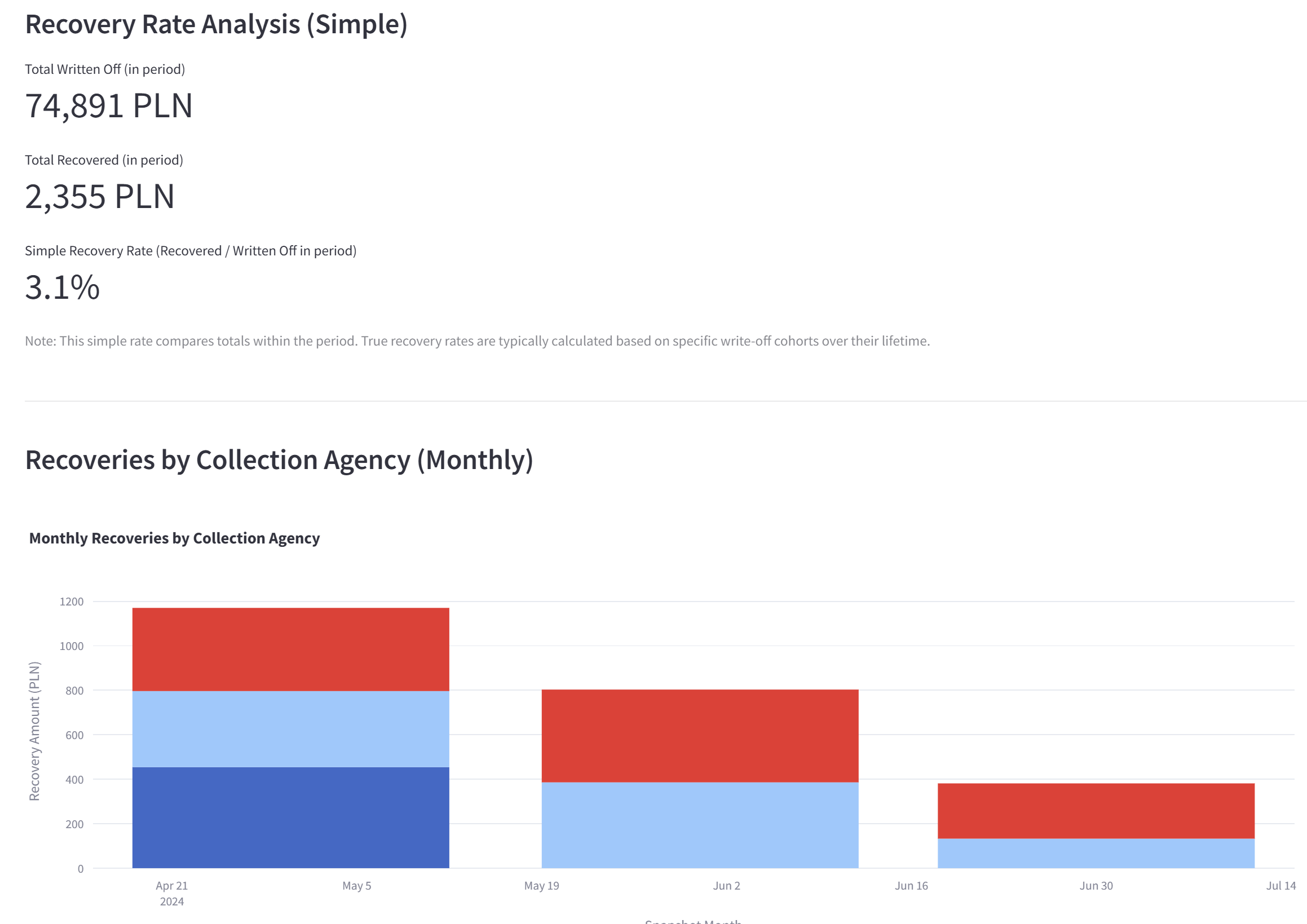

Collections teams benefit from advanced delinquency analysis frameworks, default pattern recognition, and write-off trend monitoring. The recoveries dashboard tracks collection efficiency metrics and recovery rates across different delinquency buckets and exit strategies.

All of this is delivered through a secure, fully-managed service with multiple data integration options including a user-friendly drag-and-drop interface, secure SFTP connections, and API connectivity for seamless data exchange.

Measurable Benefits Across the Lending Lifecycle

Financial institutions implementing automated loan performance monitoring systems realize significant operational and financial benefits throughout the lending lifecycle. The most immediate impact comes from time savings—analysts report reclaiming 25-30 hours monthly previously dedicated to manual reporting tasks. From a risk management perspective, earlier identification of concerning trends leads to measurable reductions in credit losses.

The loan portfolio data integration solution also enhances decision-making throughout the organization. Sales teams gain clearer visibility into acquisition channel performance, allowing for optimization of marketing spend toward sources delivering higher quality loans. Financial planning becomes more accurate with real-time portfolio data, while compliance teams benefit from consistent reporting across all lending operations.

Perhaps most importantly, the centralized visibility provided by the dashboard fosters greater collaboration between previously siloed departments. When origination, underwriting, and collections teams work from the same data foundation, the entire lending operation becomes more cohesive and responsive to changing market conditions.

Experience the Difference

Taking the next step toward transforming your loan portfolio management is straightforward. The most effective way to understand the full potential of our solution is to experience it with your own portfolio data. Our implementation specialists can deploy a customized demonstration environment populated with a sample of your actual loan data, allowing you to see exactly how the dashboard would function within your specific lending context.

This personalized approach ensures that the demonstration addresses your organization’s unique challenges and requirements. During the demonstration, our team will highlight the specific features most relevant to your lending operations and show how the solution integrates with your existing systems. We’ll also provide a roadmap for full implementation, including timeframes, resource requirements, and expected outcomes.

Don’t wait for the next month-end reporting cycle to experience the difference. After all, continuing with manual reporting in today’s digital lending environment is like bringing a spreadsheet to a data science fight.

Transform Your Portfolio Visibility Today

Contact us now to schedule your personalized demonstration and see firsthand how our loan portfolio monitoring dashboard can transform your financial reporting and risk management capabilities. Our team will configure a custom demo using your actual portfolio data within just 72 hours of receiving your sample dataset.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Daniel Zacatenco on Unsplash