Financial departments in non-financial companies face unprecedented complexity when attempting to model business outcomes in today’s volatile market conditions. Traditional spreadsheet-based approaches no longer suffice when executives demand rapid, accurate analysis of multiple scenarios with complex interdependencies. Our innovative cloud-based FP&A simulation tool delivers the computational power, flexibility, and intuitive visualization capabilities that modern financial teams require to navigate uncertainty with confidence.

The Growing Complexity Crisis in Financial Modeling

Finance leaders across industries are experiencing a critical inflection point. The traditional tools and methodologies that served financial departments for decades are faltering under increased demands for faster decision cycles, more nuanced scenario analysis, and greater forecast accuracy. Retail financial analysts frequently generate forecasts that become obsolete before quarterly review meetings occur. Healthcare finance teams struggle to model the cascading effects of pricing changes across service lines with different margin structures.

These challenges manifest most acutely when attempting to create multiple financial scenarios for strategic planning. The process typically involves duplicating complex spreadsheets, manually adjusting formulas, and somehow maintaining version control – all while ensuring that interconnected calculations remain intact. When executive leadership inevitably asks for additional scenarios or parameter adjustments during presentations, finance teams find themselves unable to provide timely answers.

Meanwhile, the increasing volatility in global markets demands not just discrete scenarios but probabilistic views of financial outcomes. Traditional tools offer no practical way to perform robust sensitivity analysis or employ monte carlo simulations to determine confidence intervals for projections. For most companies, these advanced analytical techniques remain theoretical concepts rather than practical business tools.

If your finance team’s idea of scenario planning involves twenty versions of the same spreadsheet with increasingly cryptic filenames, you might need a simulation upgrade – your “Budget_v4_FINAL_ACTUAL_rev2.xlsx” is screaming for help.

Reimagining Financial Modeling for Today’s Business Environment

Our financial simulation platform represents a paradigm shift in how non-financial companies approach financial modeling and scenario analysis. Built from the ground up as a comprehensive and managed FP&A simulation tool, the platform eliminates the technological barriers that previously made advanced financial modeling the exclusive domain of specialized analysts.

Advanced Scenario Modeling Architecture

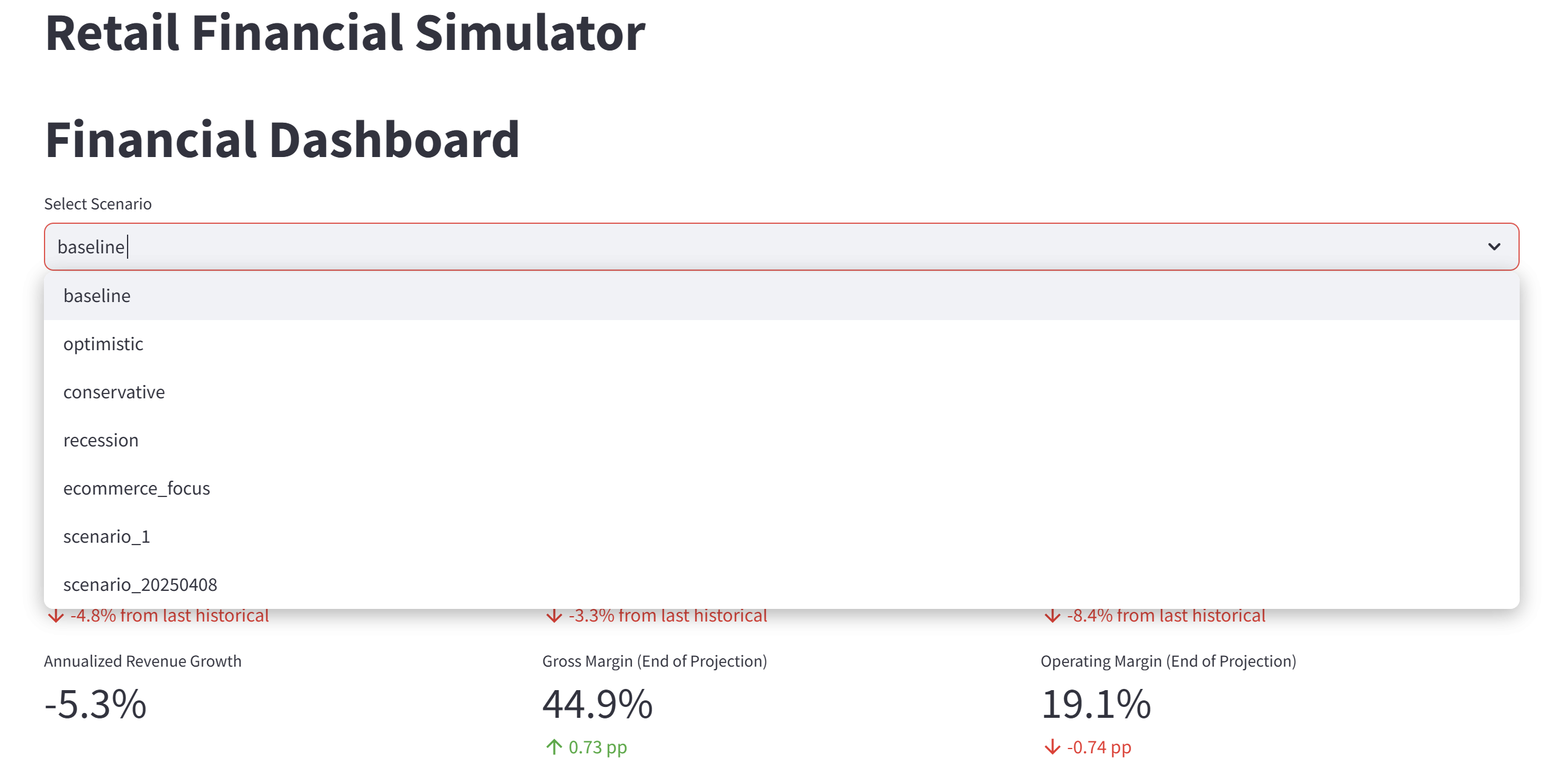

The core of our solution is a sophisticated scenario modeling engine that maintains complete separation between input parameters and calculation logic. This architectural approach enables financial teams to create unlimited scenarios without duplication of underlying models. Each scenario becomes a distinct parameter set applied to the shared computational framework, ensuring consistency while dramatically reducing complexity.

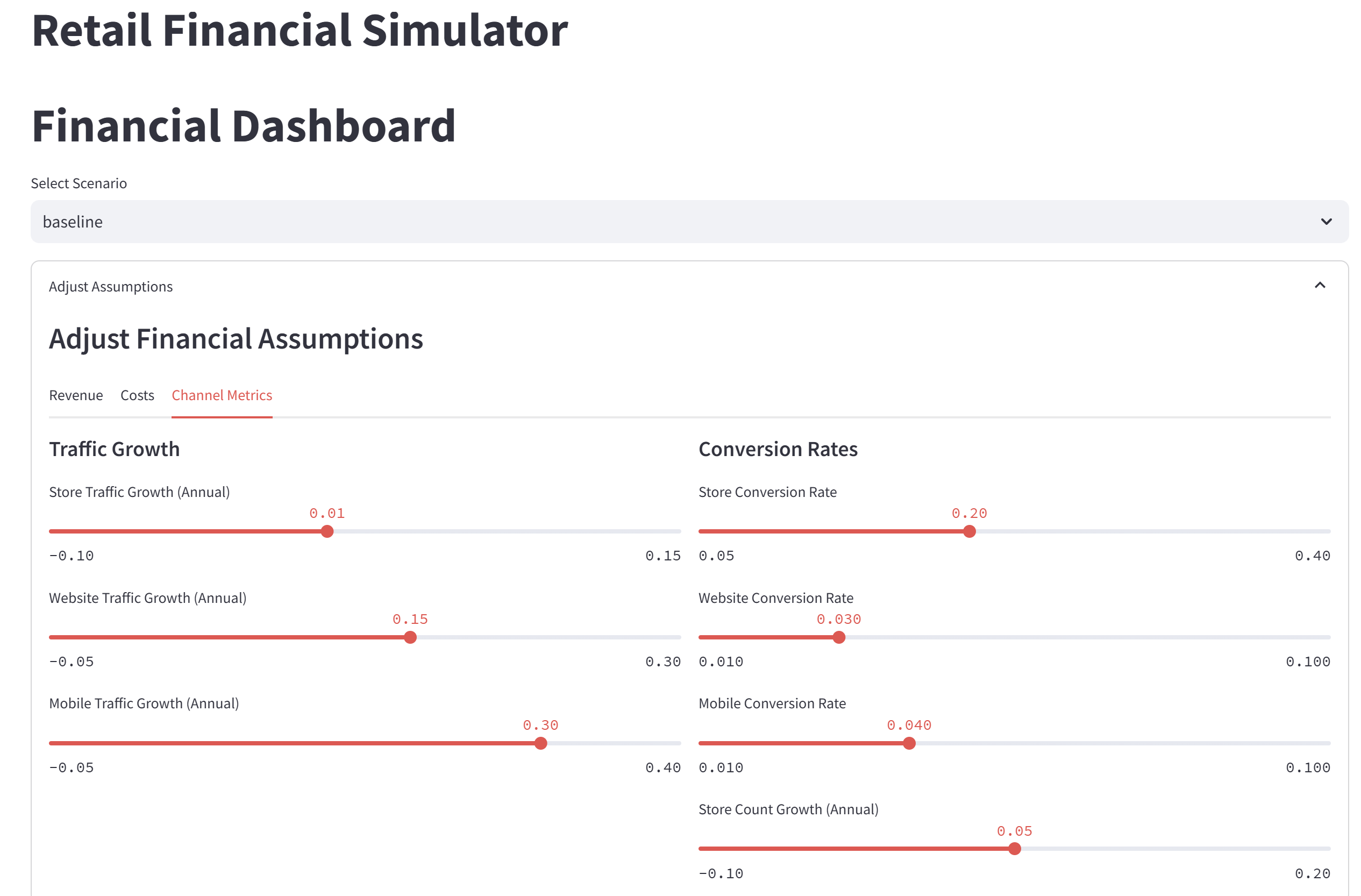

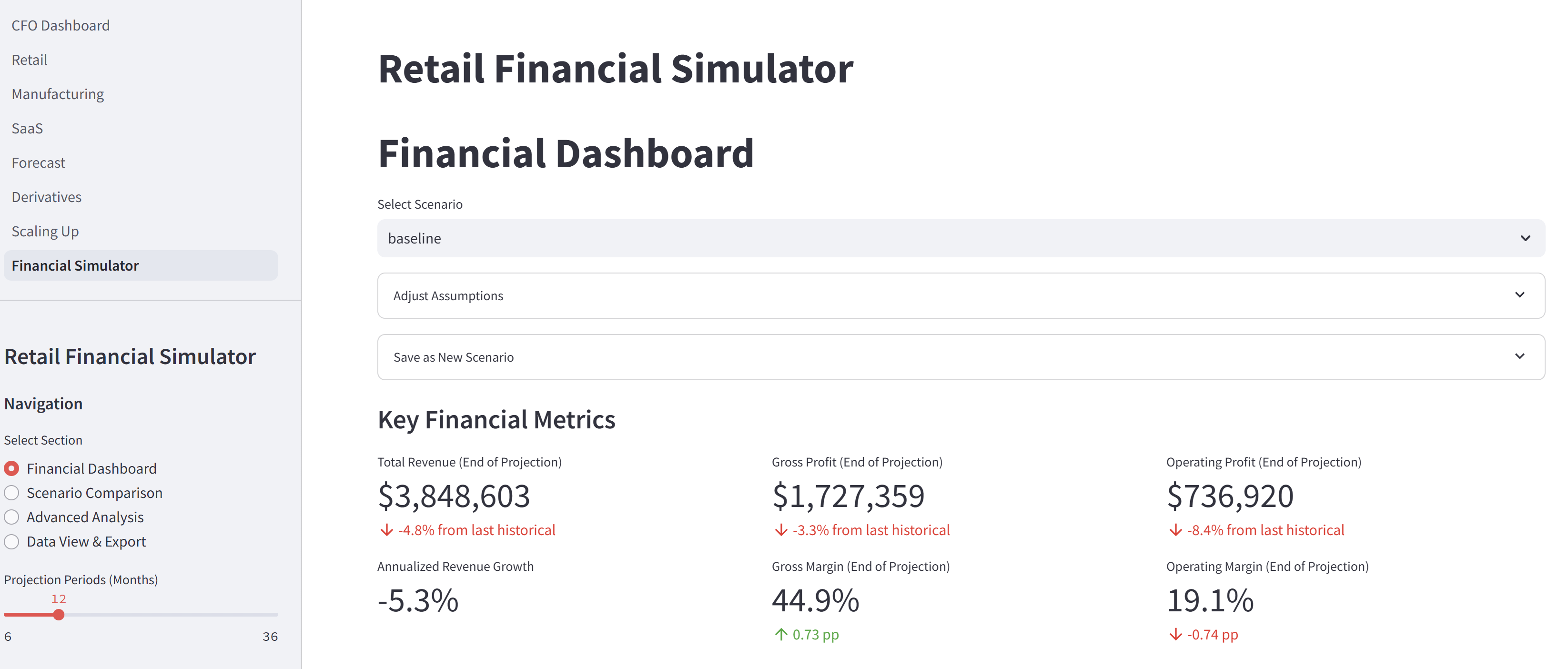

The platform includes predefined scenario templates addressing common business situations such as market expansion, pricing strategy adjustments, and cost optimization initiatives. These templates provide structured starting points that financial teams can customize to their specific circumstances. The intuitive parameter adjustment interface allows real-time modification of assumptions with immediate recalculation of outcomes – a capability particularly valuable during executive presentations when unexpected questions arise.

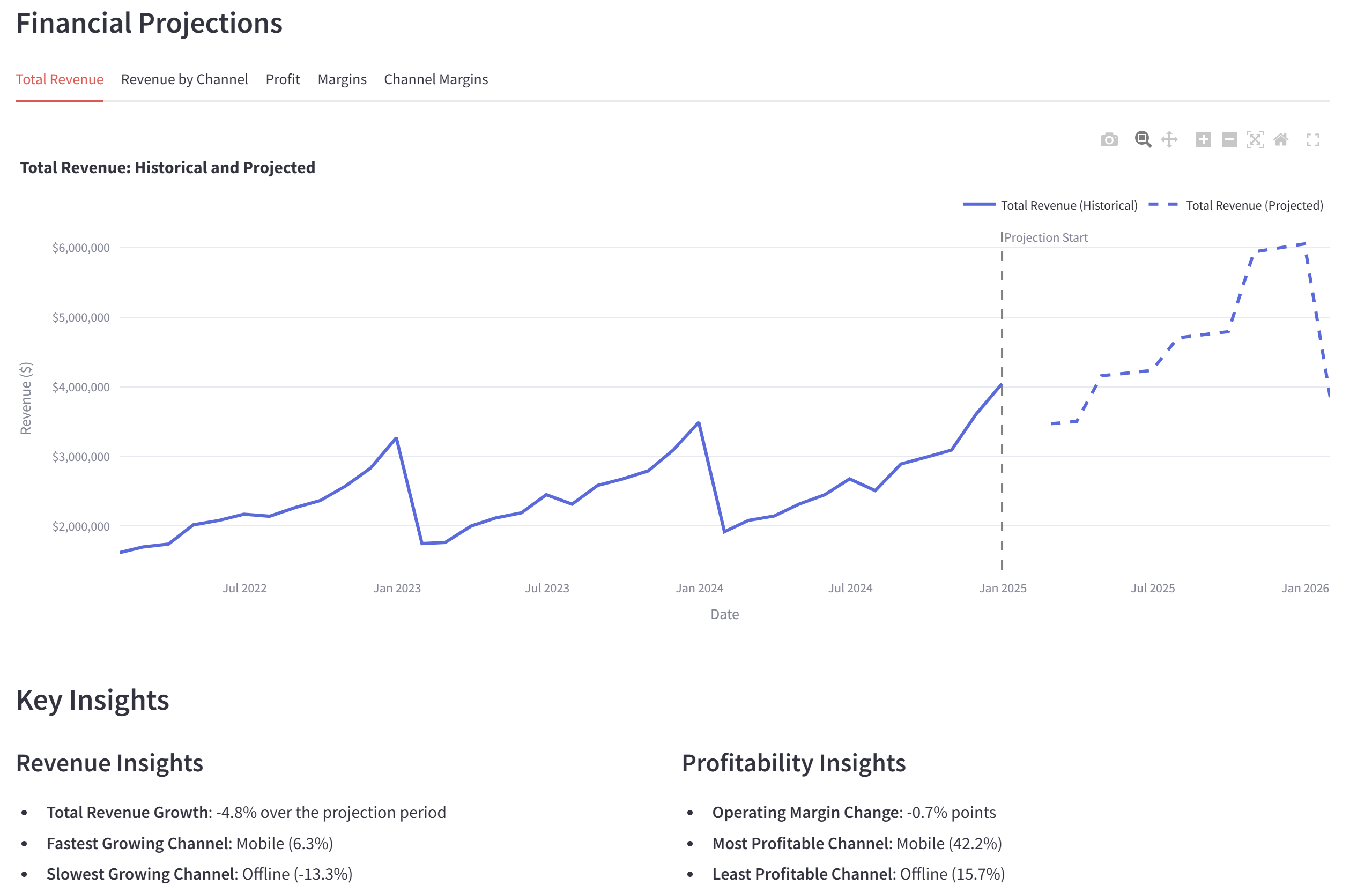

Comparative visualization tools automatically generate side-by-side analyses of different scenarios, with customizable dashboards highlighting key metrics such as revenue by channel, profit margins, and cash flow projections. The platform maintains a comprehensive audit trail of scenario evolution, enabling teams to track the development of their financial models over time.

Statistical Rigor Through Advanced Analytics

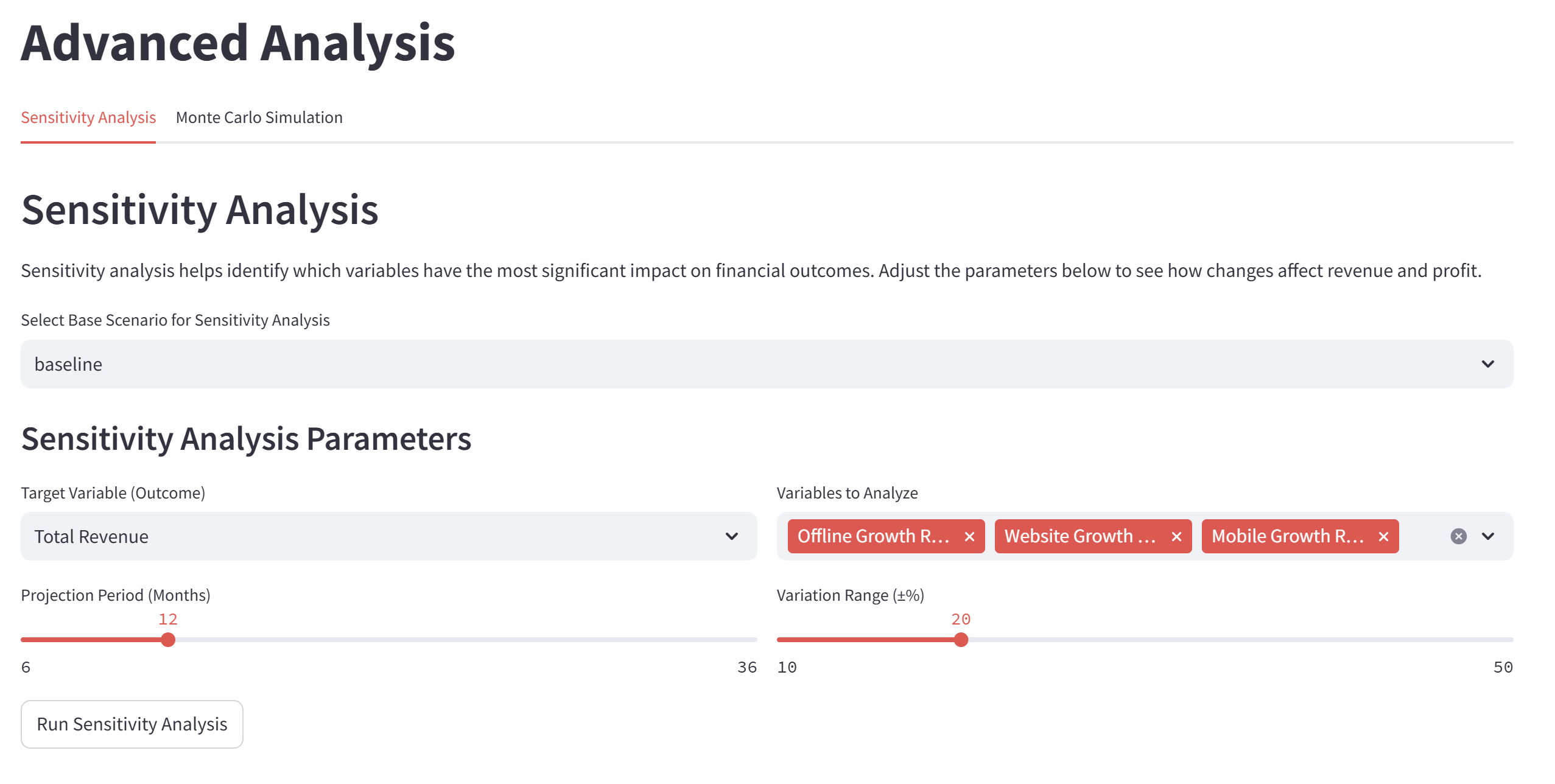

For organizations requiring deeper analytical capabilities, our platform incorporates sophisticated statistical techniques traditionally found only in specialized financial modeling applications. The sensitivity analysis module employs variance-based methods to identify which input parameters have the greatest impact on key financial outcomes. The resulting tornado charts provide immediate visual insight into model sensitivities, helping teams focus their attention on the variables that truly matter.

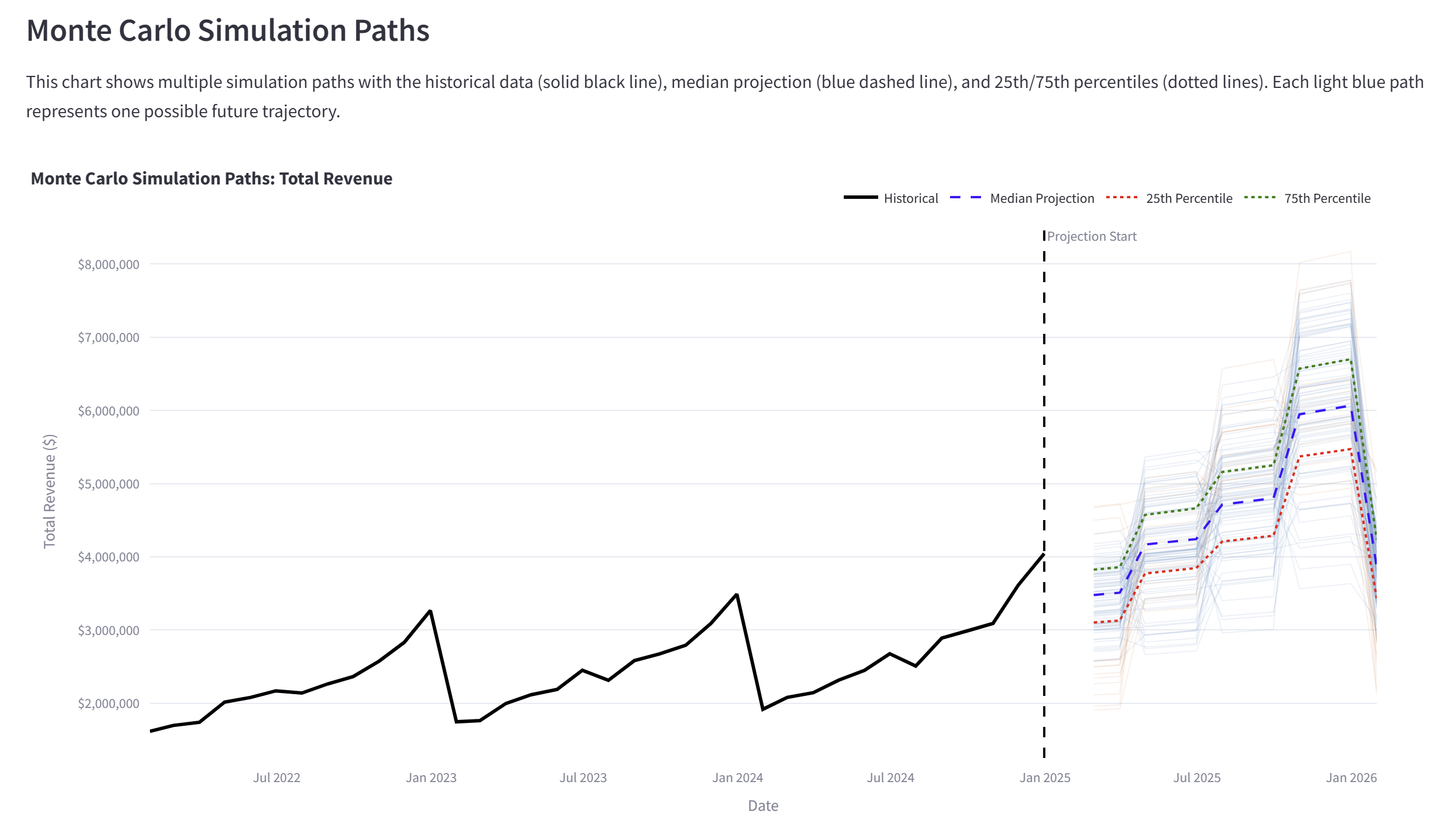

The monte carlo simulation for financial forecasting functionality takes uncertainty modeling to an entirely new level. Rather than generating single-point forecasts, this module enables the creation of probability distributions for key financial metrics by running thousands of simulations with randomized inputs according to user-defined parameters. The resulting confidence intervals provide executives with a nuanced understanding of potential outcomes and associated risks.

Forward-Looking Projections With Time Series Intelligence

Complementing the scenario-based approach, our time series forecasting module leverages Prophet algorithm technology to generate forward-looking projections based on historical data patterns. This capability is particularly valuable for organizations dealing with seasonal variations or complex trend patterns that traditional forecasting methods struggle to capture accurately.

The forecasting engine automatically detects outliers and anomalies in historical data, ensuring that projections aren’t skewed by non-representative past events. Financial teams can overlay scenario assumptions onto baseline forecasts, enabling them to visualize how strategic decisions might alter the organization’s expected trajectory.

Infrastructure and Security

Recognizing the sensitive nature of financial data, we’ve implemented comprehensive security measures throughout the platform. All connections employ HTTPS encryption, and a robust authentication system ensures that only authorized personnel can access specific scenarios and data sets. The managed infrastructure eliminates the need for on-premises hardware while providing the computational power necessary for complex simulations.

Data integration capabilities include a user-friendly drag-and-drop interface for file imports, secure SFTP connections for automated data transfers, and a comprehensive API for real-time integration with enterprise systems. Each client implementation is customized to address specific data sources and business requirements, ensuring seamless operation within existing technology landscapes.

Tangible Benefits for Financial Teams

Organizations implementing financial simulation platform report significant improvements in both efficiency and effectiveness of their financial planning processes. Manufacturing clients indicated reduction in time spent creating and maintaining financial models, freeing finance professionals to focus on strategic analysis rather than mechanical calculations.

Perhaps more importantly, the quality and confidence in financial projections dramatically increases. Retail clients report reducing forecast error rates after implementing monte carlo simulation capabilities, leading to more accurate inventory planning and improved cash utilization.

Beyond the immediate benefits of improved forecasting, organizations experience longer-term advantages from their enhanced analytical capabilities. The ability to rapidly test hypotheses and model potential outcomes fosters a more agile, data-driven decision culture throughout the organization. Financial teams transition from reactive reporting functions to proactive strategic advisors, armed with powerful tools that elevate their contributions to executive decision-making.

Taking the Next Step Toward Financial Modeling Excellence

Experiencing the transformative capabilities of our financial simulation platform begins with a personalized demonstration. Our team of financial modeling specialists will configure a demonstration environment populated with representative data from your industry, allowing you to explore the platform’s capabilities in a familiar context.

Following the initial demonstration, many organizations opt for a limited proof-of-concept implementation focused on a specific modeling challenge. This approach provides tangible evidence of the platform’s value while minimizing initial resource commitments. Our implementation specialists work directly with your financial team to configure the necessary scenarios and establish appropriate data connections.

For organizations ready to proceed with full implementation, our structured onboarding process ensures rapid time-to-value while building internal capability. The modular nature of the platform allows for phased implementation, typically beginning with core scenario modeling functionality before expanding to advanced analytical techniques.

When it comes to transforming your financial modeling capabilities, your competitors are probably already running simulations – while you’re still trying to fix circular references in your spreadsheets.

Unlock the Full Potential of Your Financial Data Today

Contact our team today to schedule your personalized demonstration, customized with your actual financial data. Discover how our cloud-based simulation platform can transform your financial planning process from a spreadsheet nightmare into a strategic advantage.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Piotr Chrobot on Unsplash