- From Data Chaos to Strategic Insight: The Evolution of Derivatives Management

- The Hidden Costs of Derivatives Data Fragmentation

- Breaking the Manual Processing Cycle

- Transforming Treasury Operations Through Advanced Data Integration and Visualization

- Measurable Benefits: From Operational Efficiency to Strategic Advantage

- Experience the Transformation: Your Path to Advanced Derivatives Management

From Data Chaos to Strategic Insight: The Evolution of Derivatives Management

In today’s volatile financial landscape, treasury departments across non-financial companies face an increasingly complex challenge: managing derivatives exposure effectively with outdated tools and processes. Financial teams struggle daily with fragmented data sources, manual spreadsheet manipulations, and limited visibility into their derivatives portfolios. The market’s rapid fluctuations demand real-time insights, yet most treasury operations remain anchored to time-consuming, error-prone processes that delay critical decisions. This reality creates significant blind spots in risk assessment, particularly when market conditions shift unexpectedly. When currencies fluctuate or interest rates spike, many treasury departments find themselves scrambling for answers rather than executing prepared strategies. Your derivatives data shouldn’t be harder to find than your car keys on a Monday morning.

The Hidden Costs of Derivatives Data Fragmentation

The consequences of inadequate derivatives management extend far beyond operational inefficiency. CFOs face challenging board presentations without concrete data to support their hedging strategies. Treasury Directors struggle to model potential market scenarios, often resorting to oversimplified assumptions that fail to capture true exposure. Financial Risk Managers find themselves reacting to market movements rather than anticipating them, while analysts dedicate countless hours to data preparation instead of delivering actionable insights.

These challenges manifest in real business impacts. Companies frequently maintain suboptimal hedging positions due to limited visibility, resulting in unnecessary costs or unaddressed risks. Executive decisions lack the empirical foundation needed for confidence, while compliance requirements add another layer of complexity to already strained processes. In the current interest rate environment, each day of delay in adjusting positions potentially costs thousands in opportunity losses or unexpected exposures.

Breaking the Manual Processing Cycle

The traditional approach to derivatives management relies heavily on manual interventions – extracting data from various systems, consolidating information in spreadsheets, building custom calculations, and creating presentation-ready visualizations. This workflow breaks down precisely when it’s most needed: during rapid market shifts when timely decisions matter most. The limitations become particularly evident when stress-testing portfolios against multiple scenarios, an exercise that can take days with conventional methods.

Transforming Treasury Operations Through Advanced Data Integration and Visualization

Our treasury derivatives data integration system fundamentally reimagines how financial departments interact with derivatives information. By combining automated data feeds, sophisticated analytics, and intuitive visualization, the platform eliminates the traditional barriers to effective derivatives management. The solution addresses the complete workflow from data acquisition through analysis to executive communication.

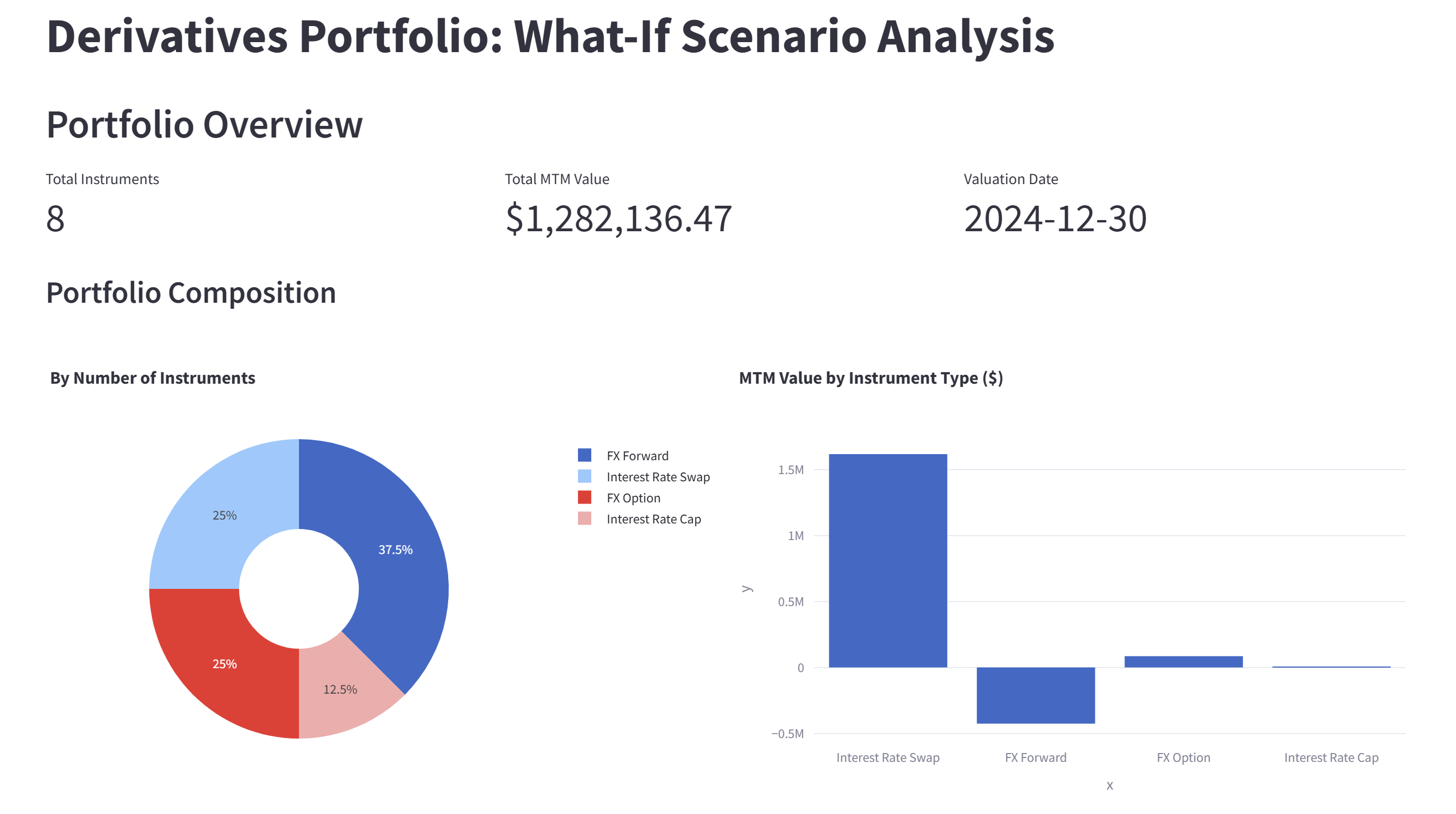

The core of the system is a comprehensive derivatives portfolio visualization dashboard that provides immediate insights into holdings distribution and mark-to-market valuations. Financial teams gain unprecedented visibility into their positions, with the ability to drill down from portfolio-level summaries to instrument-specific details. This multi-dimensional view enables both strategic oversight and tactical execution.

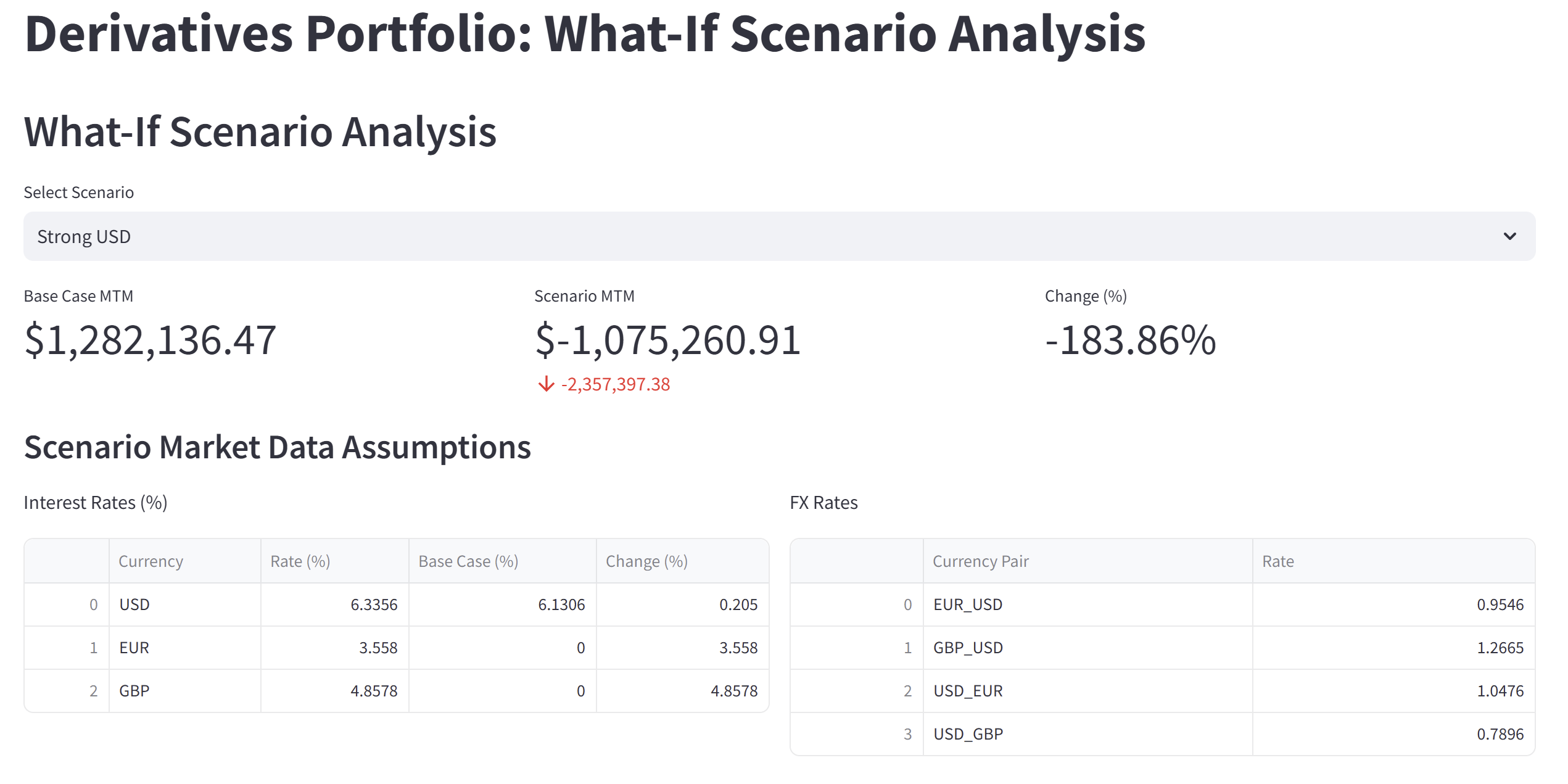

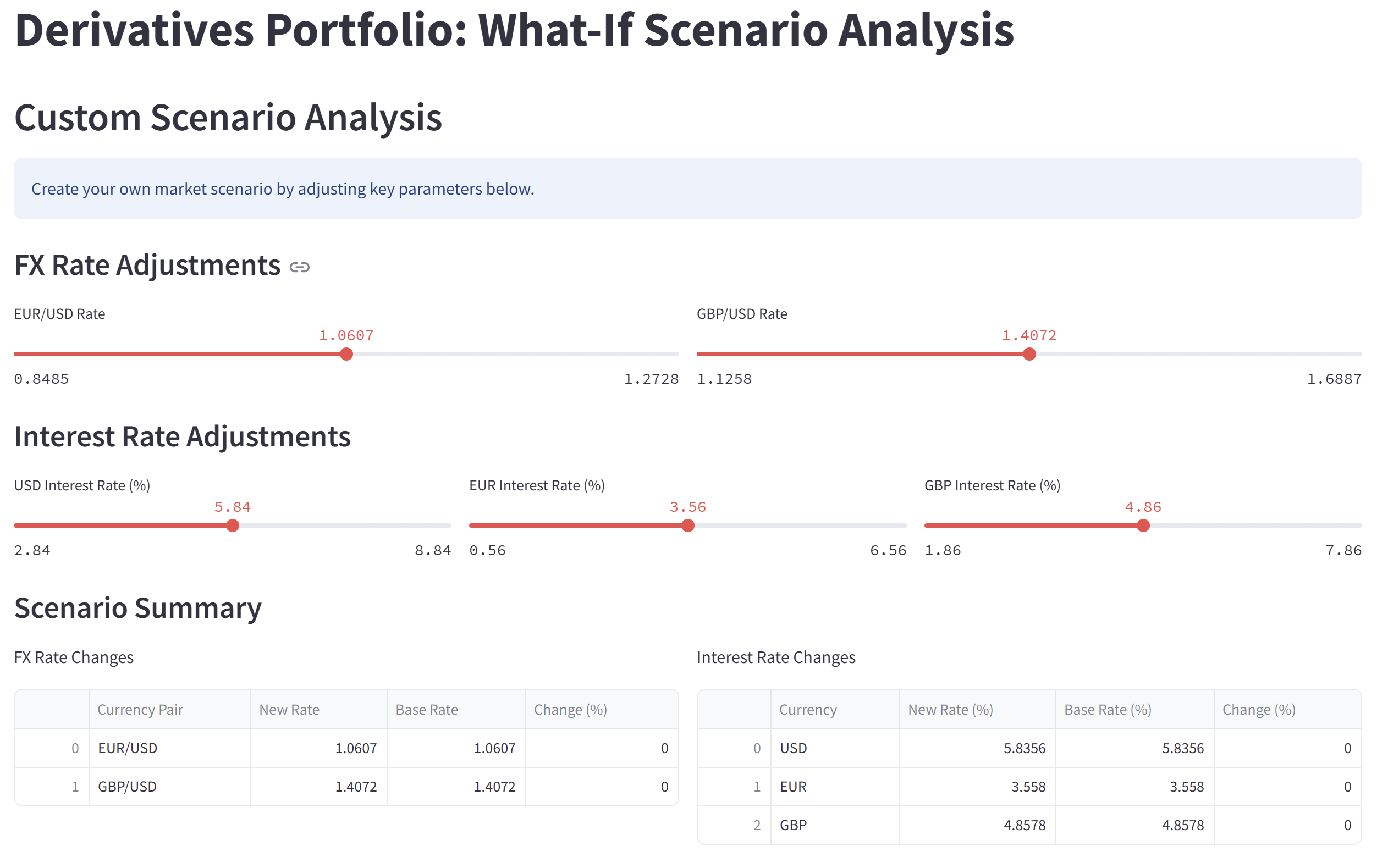

Perhaps the most powerful capability is the advanced what-if scenario analysis tool for finance professionals. The system comes with predefined scenarios that model market shifts like “Strong USD” or “Rising Rates,” instantly showing the impact across the portfolio and individual positions. Historical context is automatically incorporated, allowing users to compare projected outcomes against similar past events. For deeper analysis, users can configure custom stress-test scenarios by adjusting specific parameters like FX rates or interest curves to model precisely the conditions they want to examine.

The platform prioritizes security through encrypted HTTPS connections and robust user authentication protocols, ensuring that sensitive financial information remains protected. Implementation follows a managed service approach, eliminating the need for clients to maintain technical infrastructure or manage complex deployments. This allows treasury teams to focus on financial analysis rather than technology management.

Data integration flexibility stands as a key differentiator, with multiple exchange options including an intuitive drag-and-drop interface, secure SFTP transfers, and API connectivity for automated feeds. This versatility ensures smooth implementation regardless of existing systems or technical resources. Each deployment is customized to address specific client requirements, recognizing that derivatives management needs vary significantly across industries and organizations.

Measurable Benefits: From Operational Efficiency to Strategic Advantage

Companies implementing automated derivatives risk dashboards report transformative outcomes across multiple dimensions. Risk assessment cycles compress from days to minutes, enabling more frequent portfolio evaluations and timely adjustments to market conditions.

The improved visibility translates directly to financial benefits. Enhanced hedging decisions typically reduce costs through more precise instrument selection and timing. Organizations gain the ability to respond proactively to market opportunities rather than reacting after movements occur. The platform also strengthens governance and compliance capabilities, providing comprehensive audit trails and documentation of decision processes.

Beyond immediate operational improvements, the solution enhances strategic communication between treasury and executive leadership. Complex derivatives information becomes accessible through intuitive visualizations, facilitating more productive discussions about risk management strategies. This alignment between technical details and business objectives represents perhaps the most significant long-term benefit, elevating treasury’s strategic contribution to organizational success.

Experience the Transformation: Your Path to Advanced Derivatives Management

The journey toward transformed derivatives management begins with experiencing these capabilities firsthand. Our interactive demo showcases how your specific derivatives data would appear within the system, providing a concrete visualization of the potential impact on your operations. This personalized approach ensures relevance to your particular challenges and portfolio composition.

The implementation process typically progresses from initial demonstration through data integration design, customization of analytics parameters, and final deployment. Our specialists guide clients through each phase, ensuring alignment with existing workflows and systems. The outcome is a seamlessly integrated solution that delivers immediate value while establishing a foundation for ongoing enhancement.

Understanding your derivatives exposure shouldn’t require an advanced degree in data wrangling – your treasury team deserves better tools for these critical decisions. After all, if you can track a pizza delivery in real-time, shouldn’t you be able to monitor your currency exposures just as easily?

Take Control of Your Derivatives Portfolio Today

Contact us now to schedule your personalized demonstration using your actual derivatives data. Discover how automating derivatives data feeds for treasury can transform your risk management processes within weeks, not months. Market volatility won’t wait – neither should your decision to gain complete portfolio visibility and control.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Sawyer Bengtson on Unsplash