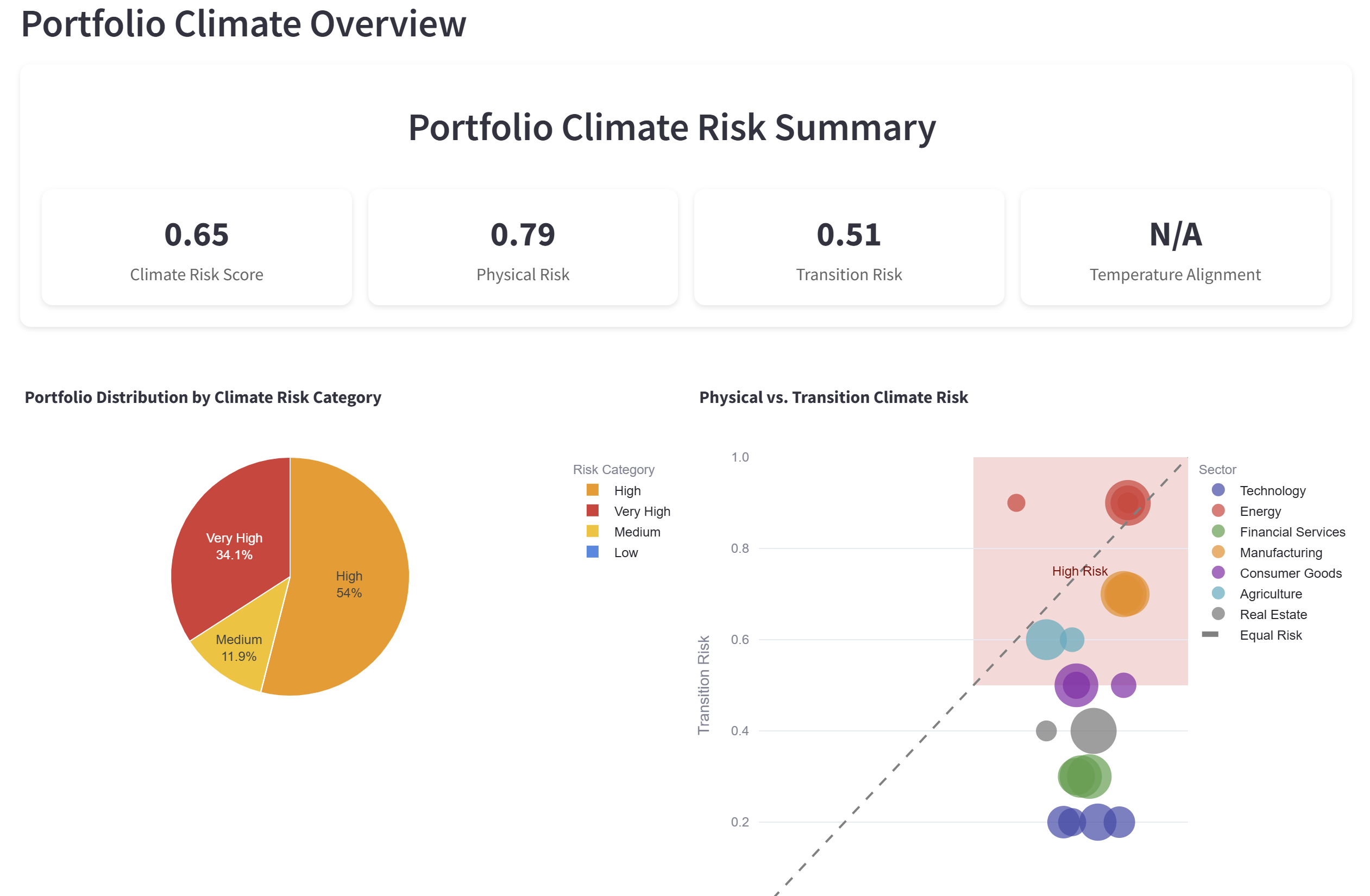

Financial institutions face a mounting challenge: incorporating climate metrics into decision-making while struggling with fragmented, inconsistent data sources. This disconnect creates significant operational inefficiencies and compliance risks. Our pioneering climate data integration platform eliminates these barriers, transforming how financial teams incorporate climate considerations into their core workflows.

The Hidden Cost of Climate Data Fragmentation

Financial institutions increasingly recognize climate factors as critical to risk assessment and regulatory compliance. However, the path to implementation remains fraught with obstacles. ESG data analysts at asset management firms regularly confront conflicting emissions values from providers like MSCI and S&P Global, forcing them to spend valuable days manually reconciling discrepancies before updating portfolio metrics.

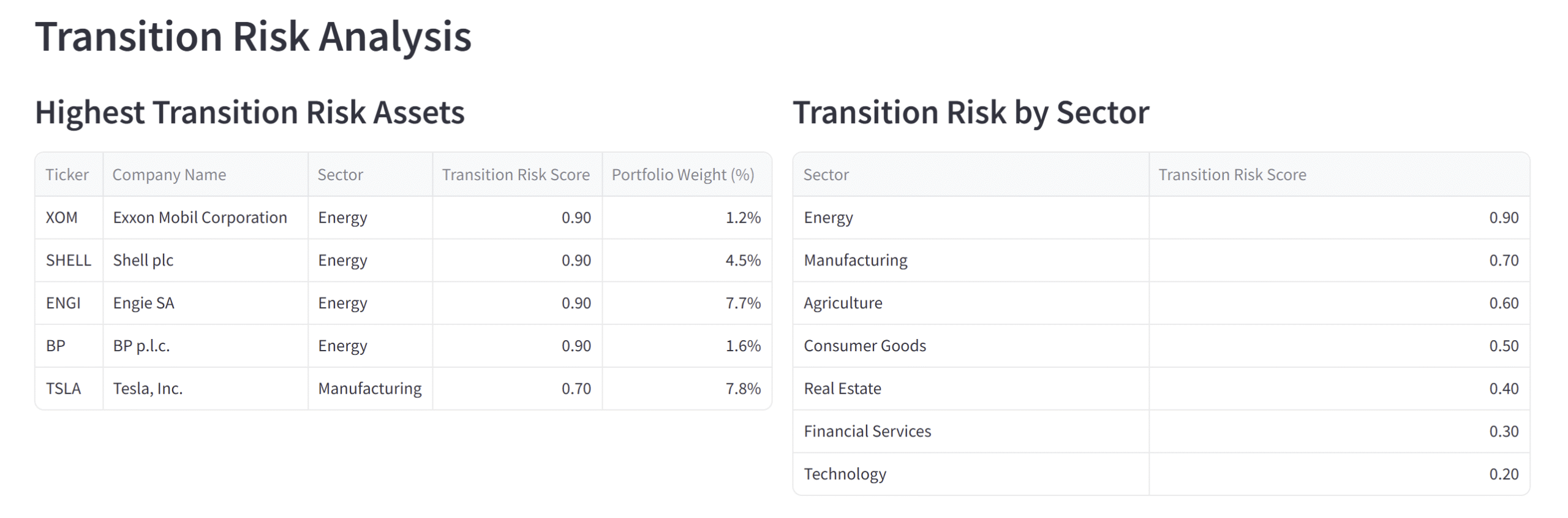

This fragmentation extends beyond mere operational inefficiency. Investment banks evaluating lending decisions frequently discover outdated or inconsistent climate risk assessments, potentially mispricing risk across their portfolios. Meanwhile, insurance companies struggle to systematically compare physical climate risks from multiple modeling sources when assessing property portfolios.

The challenges reconciling climate data vendors create ripple effects throughout organizations. Pension fund managers report spending weeks coordinating between data vendors, compliance teams, and IT departments to produce comprehensive Paris Agreement alignment reports. This administrative burden diverts resources from core investment activities while increasing error risk.

Perhaps most concerning, sustainability reporting managers face potential reputational damage when publishing inconsistent Scope 3 emission values. With regulatory scrutiny intensifying, the fragmented climate data impact on portfolio analysis can no longer be ignored. Financial institutions need coherent data to inform decision-making, not climate confusion served three ways.

Transforming Climate Data Chaos into Financial Clarity

Our platform directly addresses these challenges through a comprehensive climate data integration solution designed specifically for financial services workflows. The system creates a unified, audit-ready dataset through several innovative components:

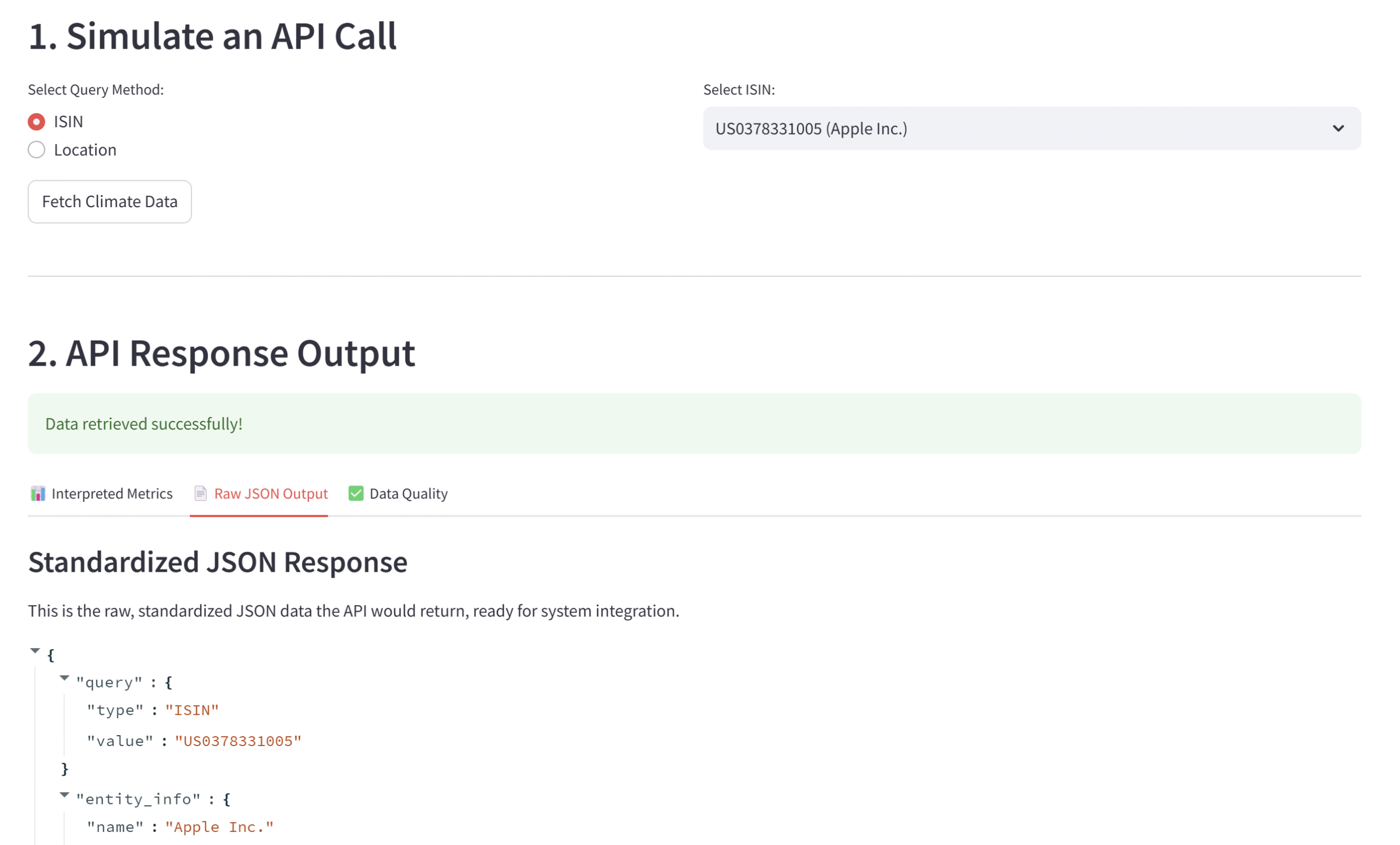

Standardized Climate Data Delivery via API

The ClimateView API component delivers validated climate metrics for any entity (via ISIN) or location, pre-formatted for immediate integration into financial risk models. This finance-ready climate data API eliminates the translation layer typically required between climate information and financial systems. The standardized data structure accommodates metrics ranging from carbon footprints to forward-looking transition risk indicators, all accessible through consistent endpoints.

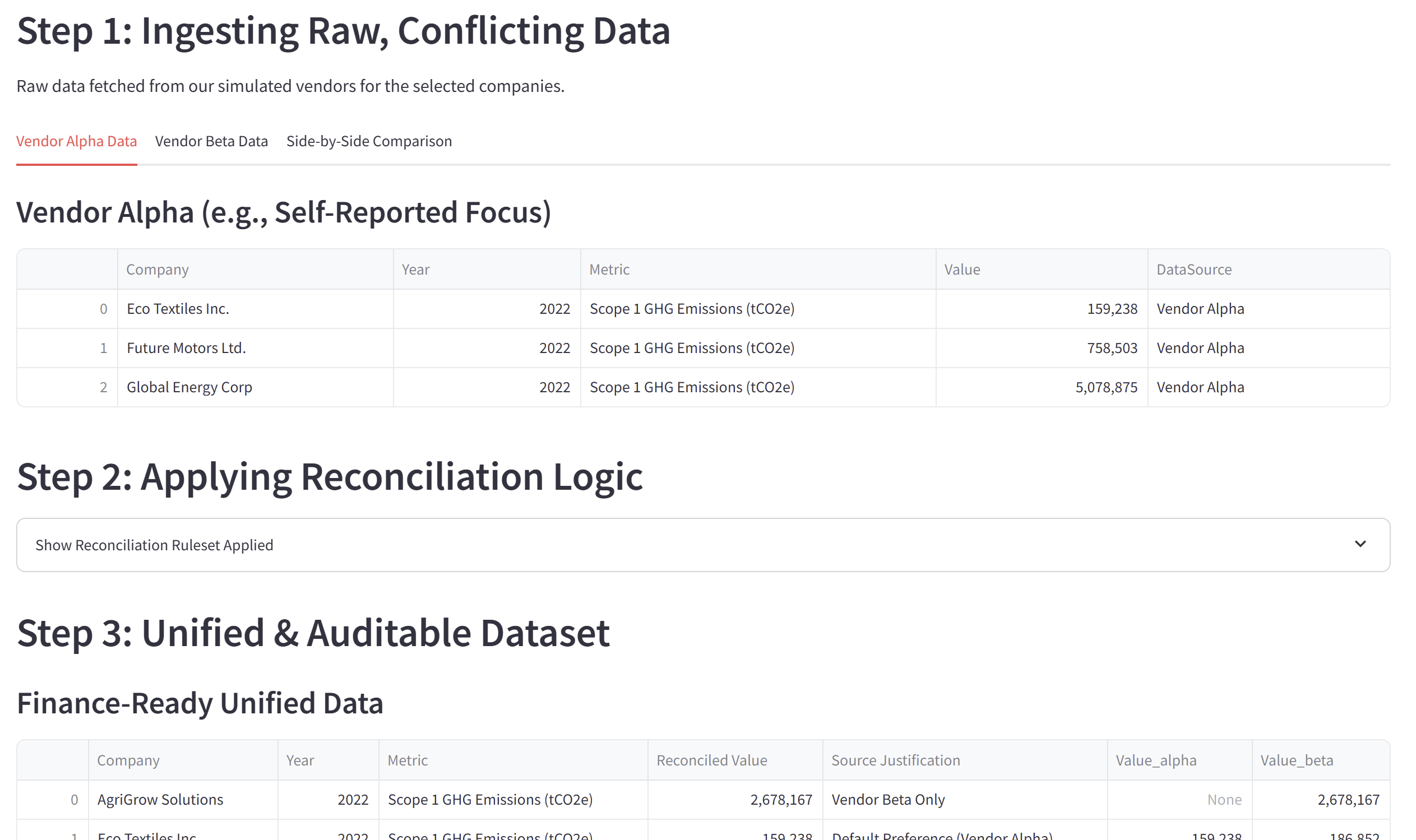

Automated Multi-Source Reconciliation

The Climate Data Reconciliation Dashboard represents a breakthrough in addressing the challenges of reconciling climate data vendors. The system ingests information from multiple providers (“Vendor Alpha” and “Vendor Beta” in our demonstration), applying sophisticated rules-based algorithms to identify discrepancies and create a unified dataset. This automated climate data reconciliation software significantly reduces manual verification workloads while improving data reliability.

Financial institutions can customize reconciliation rules based on their specific methodological preferences, ensuring consistency with internal risk frameworks. The system maintains a complete audit trail of all data transformations, supporting regulatory compliance and governance requirements.

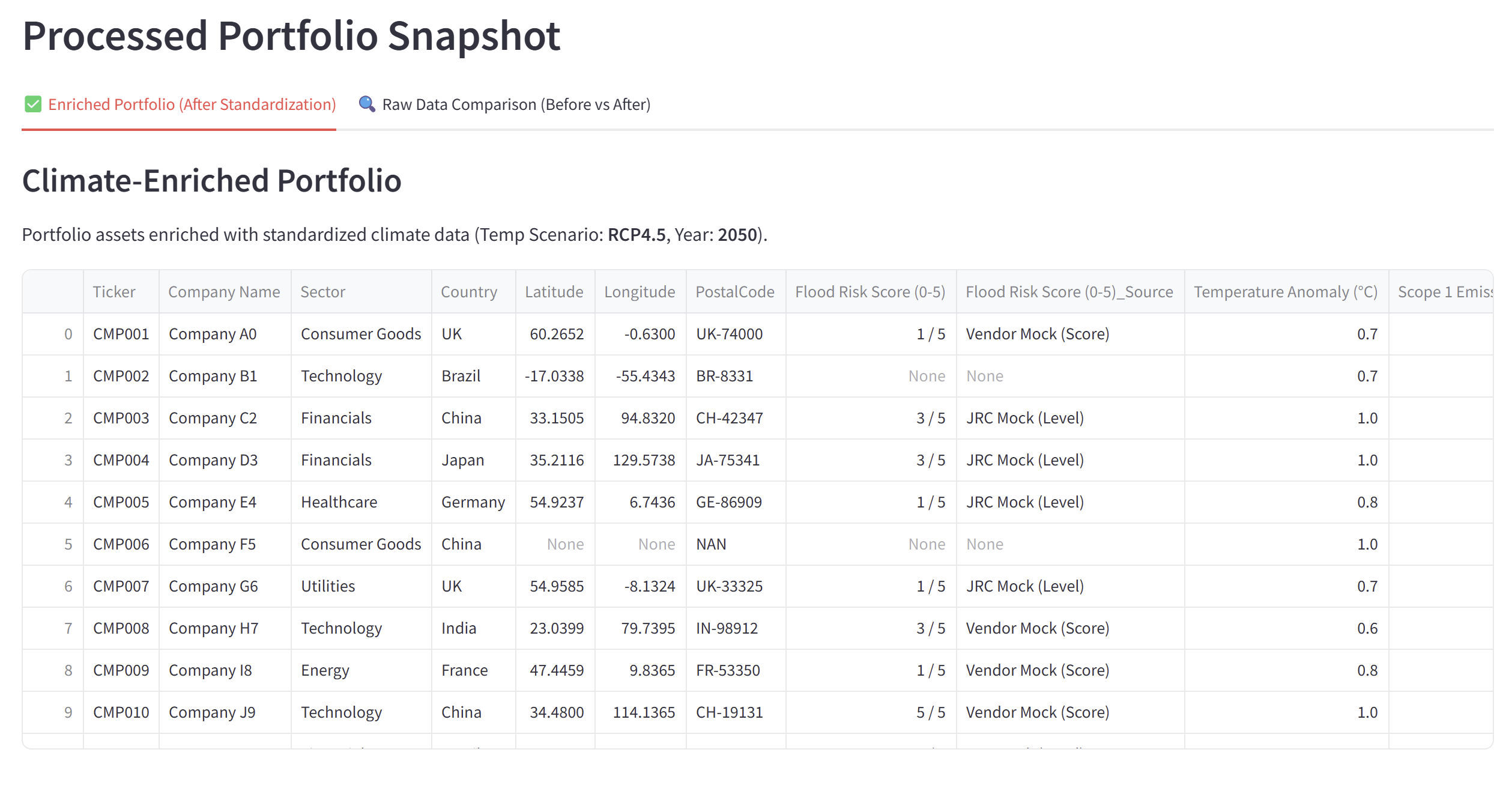

Seamless Portfolio Integration

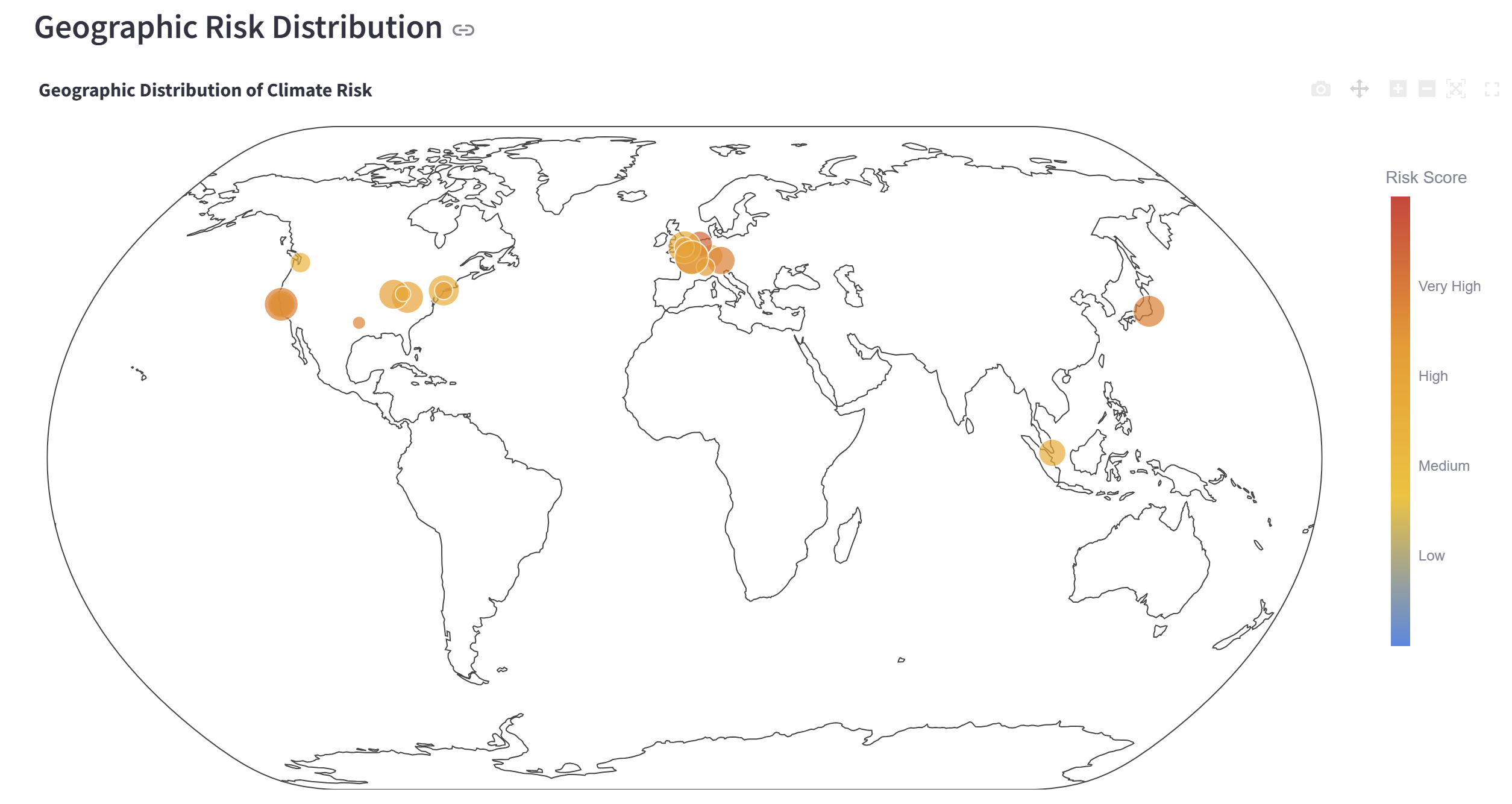

The Climate-Adjusted Portfolio Snapshot demonstrates our platform’s ability to ingest, clean, and merge external climate datasets with financial portfolios. This integration bridges the gap between climate information and investment decision-making, enabling portfolio managers to incorporate physical and transition risks into their standard analysis.

The system supports climate data ingestion for financial services through multiple secure channels. Users can leverage a drag-and-drop interface for ad-hoc analysis, establish automated SFTP connections for recurring data flows, or implement direct API integration for real-time applications. Each implementation pathway maintains rigorous security controls, including HTTPS connections and robust user authentication.

Enterprise-Grade Deployment Options

Recognizing the diverse technical environments across financial institutions, our platform offers flexible deployment options. The managed service model eliminates infrastructure concerns, allowing clients to focus on extracting business value rather than managing technology. Each implementation is tailored to specific client requirements, acknowledging that climate risk management approaches vary across organizations.

Measurable Benefits Across The Organization

Financial institutions implementing our climate data integration platform report significant operational improvements. ESG data teams reduce reconciliation significantly, freeing analysts to focus on insight generation rather than data preparation. This efficiency gain translates to hours saved per week for a typical mid-sized asset manager.

Beyond operational efficiency, the platform delivers strategic advantages. Portfolio managers gain a more nuanced understanding of climate exposure, supporting better risk-adjusted returns.

Compliance teams benefit from streamlined regulatory reporting capabilities. The system’s audit trail and consistent methodology simplify documentation for frameworks like SFDR and TCFD. This structured approach reduces compliance preparation time by approximately 40% while improving reporting accuracy and consistency.

Long-term benefits include enhanced strategic positioning as climate-related financial regulations intensify. Organizations with robust climate data integration capabilities will maintain competitive advantages in risk management, client transparency, and regulatory adaptation.

Experience the Difference: Your Climate Data Transformation

Ready to transform how your organization handles climate information? Our interactive demonstration provides a hands-on experience with automated climate data reconciliation software in action. See firsthand how fragmented data sources become coherent financial insights through our streamlined workflow.

The demo showcases all key platform capabilities, from initial data ingestion through reconciliation and portfolio integration. You’ll experience how our system handles real-world data challenges, including inconsistent emissions reporting and varying methodological approaches.

Understanding the unique nature of each financial institution’s climate journey, we’ve designed the platform for progressive implementation. Start with core reconciliation capabilities and expand into more sophisticated integration as your climate strategy evolves. After all, your climate data journey shouldn’t be a marathon of spreadsheets – just a few clicks to clarity.

Transform Your Climate Risk Management Today

Contact us today to schedule your personalized demonstration using your organization’s actual data sources. Discover how quickly you can move from fragmented climate information to actionable financial insights. With regulatory pressures mounting and stakeholder expectations rising, can you afford to continue with disconnected climate data workflows?

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Ryo Yoshitake on Unsplash