What is FpML?

FpML (Financial products Markup Language) is an open-source standard protocol for electronic dealing and processing of financial derivatives and structured products. It is an XML-based language that facilitates the exchange of information related to financial transactions between financial institutions, including investment banks, hedge funds, asset managers, and trading platforms.

The Standard was developed by the International Swaps and Derivatives Association (ISDA) in collaboration with financial institutions, software vendors, and industry experts. The standard covers a wide range of financial products, including interest rate derivatives, credit derivatives, foreign exchange derivatives, equities, commodities, and more.

FpML enables standardized communication and integration between various financial systems and platforms, providing a more efficient and automated workflow for trade processing, confirmation, settlement, and risk management. It also helps reduce operational risks, improve transparency, and enhance regulatory compliance.

FpML has become a widely adopted standard in the financial industry, and its use is supported by many software vendors and financial institutions worldwide.

Discover the world of FpML by visiting the official website at https://www.fpml.org/. A great starting point for familiarizing yourself with the Standard is the “FpML at a Glance” page, available at https://www.fpml.org/about/fpml-at-a-glance/ . This page offers a succinct overview of the FpML specification, accompanied by a comprehensive diagram that visually represents the scope of the standard across multiple dimensions, including technology, industry coverage, governing bodies, and implementation activities. Take advantage of this valuable resource to gain a deeper understanding of the FpML Standard and its significance in the financial industry.

Goals of this blog post series

The FpML Standard is a comprehensive resource for discovering a complete list of derivatives attributes. Over time, the Standard has grown significantly, and the current version, 5.12, encompasses numerous products and business events. While the vast FpML documentation may appear overwhelming, this blog post aims to simplify the process of getting started with FpML. Specifically, the article targets business analysts who are either beginning to work with or trying to leverage FpML in their daily tasks. Our focus will center primarily on product classes while minimizing technical information and concentrating on business aspects.

Despite its popularity among large investment banks and hedge funds, the FpML Standard is a valuable tool for smaller companies as well. Even if you choose not to implement the entire Standard, it can still enhance your database design or standardize input files, leading to a more efficient workflow. This series comprises six blog articles, the first of which serves as an introduction and offers a basic overview of FpML and its product scope. The second installment will concentrate on the various components that constitute the FpML documentation. In the third article, we will delve into a single documentation page, providing an in-depth analysis. The fourth segment will demonstrate how to effectively work with XSD files in an external tool. Part five will furnish readers with valuable insights into the FpML data dictionary and its examples. Finally, we will consolidate all of the articles into a single PDF document for your convenience.

FpML Documentation Guide Series

Financial products in scope of the Standard

The “Product Summary” page available at https://www.fpml.org/about/product-summary/ provides a comprehensive overview of the products that fall under the purview of FpML. It’s worth noting that “IRD” refers to “Interest Rate Derivatives,” “CD” represents “Credit Derivatives,” and “EQD” indicates “Equity Derivatives.” The remaining products should be self-explanatory.

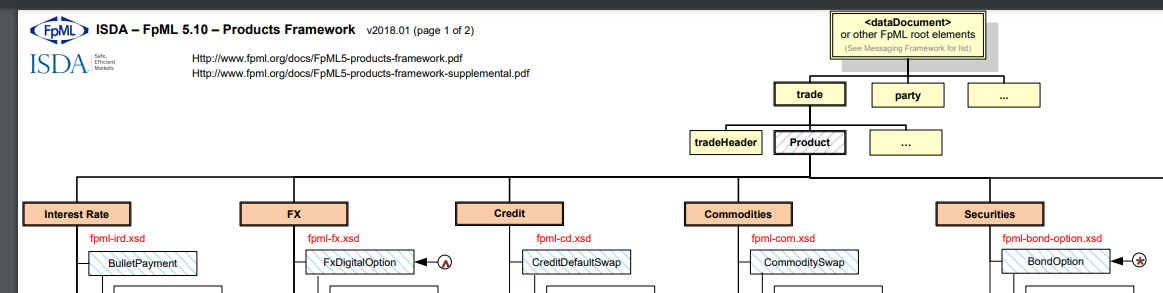

For a deeper understanding of the interdependencies between different FpML products, we recommend consulting the “Products Framework” document accessible at https://www.fpml.org/docs/FpML5-products-framework.pdf . This document outlines the relationships between various products, providing an invaluable resource for those seeking a more comprehensive understanding of FpML.

When examining the FpML Product Framework, the top-level elements are depicted in light yellow boxes. Light orange boxes denote the product class, while red text indicates the corresponding XSD file defining the class in question. Other boxes link to specific products.

For additional information on the FpML products framework, we recommend consulting the “Products Framework Supplement” available at https://www.fpml.org/docs/FpML5-products-framework-supplemental.pdf. This document includes diagrams for both the leg and option models, as well as supplementary legend information. It serves as an excellent resource for those seeking a more detailed understanding of the FpML products framework.

Use FpML® to create flexible and automated systems

Contact us and see how we can help you get started with the ISDA™ standard.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.

Photo by Florian Schneider on Unsplash