Finance departments across Europe face unprecedented pressure to comply with Corporate Sustainability Reporting Directive (CSRD) requirements – demanding extensive ESG data collection, validation, and reporting. The complexity of integrating ESG data into financial reporting systems has created significant operational burdens. Our purpose-built CSRD reporting dashboard offers finance teams a comprehensive solution to transform this regulatory challenge into a strategic advantage.

The Hidden Costs of CSRD Compliance for Finance Teams

Today’s finance departments are caught in a perfect storm of expanding responsibilities. Beyond traditional financial stewardship, they must now collect, validate, and report on hundreds of ESG data points across their organizations. This shift represents more than just additional workload – it fundamentally transforms how financial information integrates with sustainability metrics.

Manufacturing firms discovers that their finance team spent hours in a single quarter manually collecting and validating CSRD data points across twelve departments. Without standardized processes, they faced inconsistent data formats, missed deadlines, and growing frustration among team members. The finance director described their makeshift system as “building a commercial airplane while already in flight.”

For mid-sized companies newly subject to CSRD requirements, the challenges are even more acute. Many finance leaders suddenly find themselves responsible for sustainability reporting with no additional resources or specialized knowledge. One operations manager at a growing technology company admitted that interpreting CSRD requirements felt like “trying to solve a Rubik’s cube in the dark while wearing mittens.”

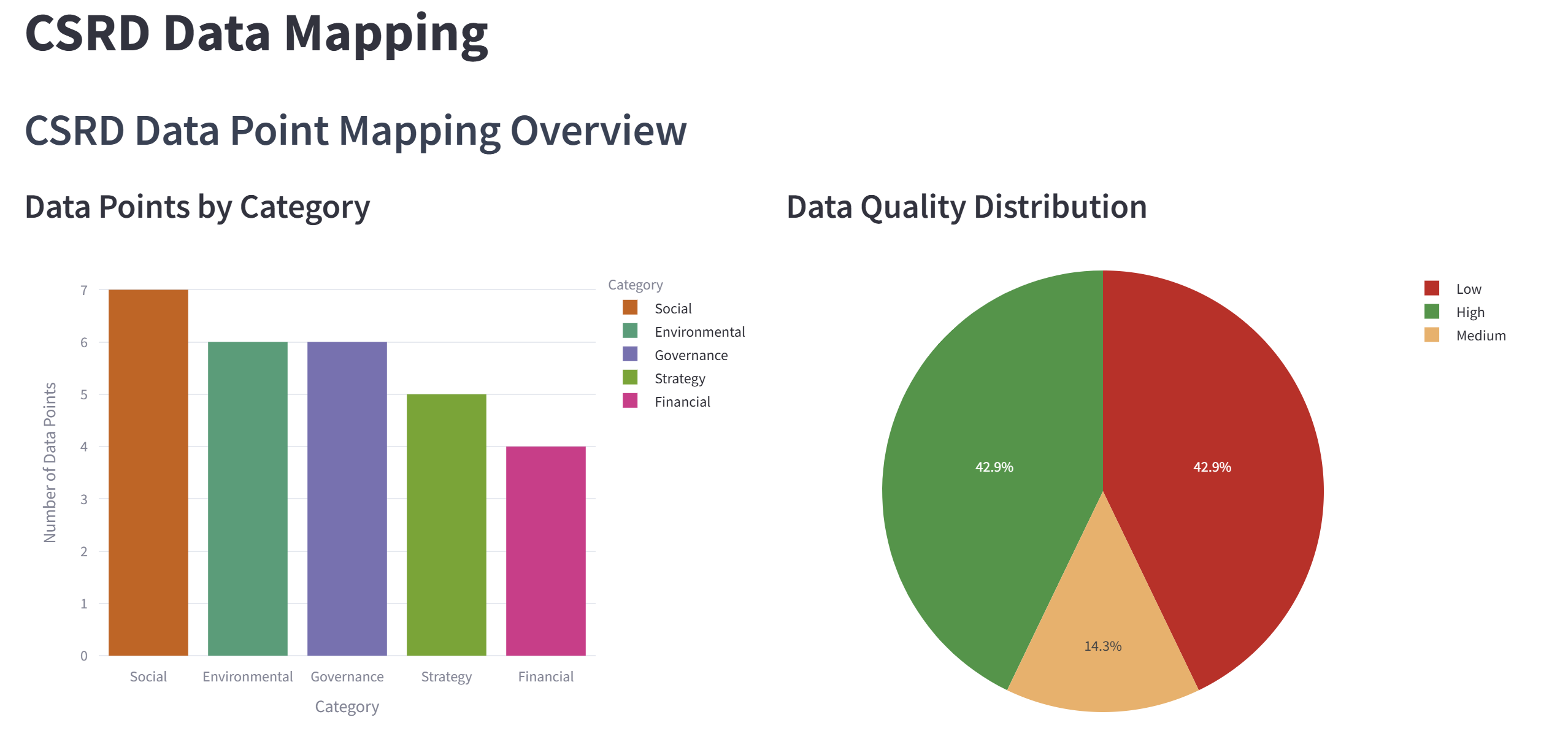

Managing ESG Data Quality for CSRD Compliance

The quality challenge extends beyond mere data collection. Finance departments must ensure that all sustainability information meets the same rigorous standards as financial reporting. This includes establishing audit trails, implementing validation protocols, and creating governance structures across departments that traditionally operate in silos.

When sustainability data lacks proper controls, the consequences can be severe. Inaccurate reporting not only risks regulatory penalties but can damage company reputation and investor relations.

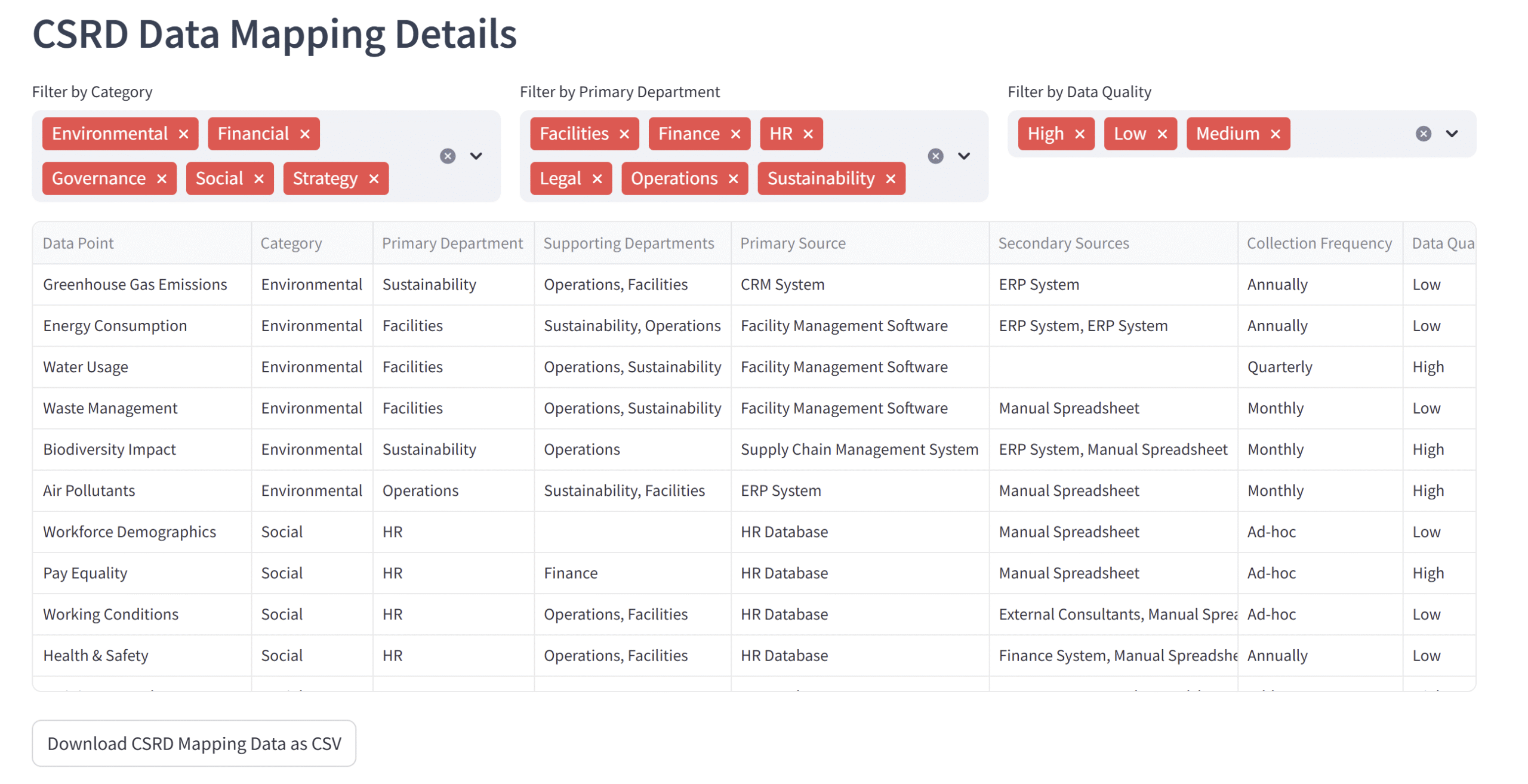

The cross-departmental nature of CSRD reporting creates additional complexity. Finance teams must coordinate with sustainability experts, operations, human resources, legal departments, and supply chain managers – each with different priorities, technical capabilities, and reporting cultures. This fragmentation leads to communication breakdowns, duplicated efforts, and critical data gaps.

Let’s face it – trying to manage CSRD reporting with spreadsheets and emails is like trying to conduct a symphony orchestra using smoke signals and carrier pigeons. It’s technically possible, but painfully inefficient and prone to spectacular failure.

A Comprehensive CSRD Reporting Solution for Modern Finance Teams

Our CSRD Reporting Dashboard addresses these challenges through a purpose-built system designed specifically for finance departments managing complex sustainability reporting requirements. The solution transforms fragmented data collection into a streamlined, secure process while providing real-time visibility into reporting progress and data quality.

Advanced Data Collection Framework

The foundation of our solution is a sophisticated data collection framework engineered to accommodate the diverse ESG metrics required by CSRD. This framework implements XBRL-ready data taxonomies that align with European Sustainability Reporting Standards (ESRS) while maintaining the flexibility to adapt as reporting requirements evolve.

The system employs a responsibility matrix that establishes clear data ownership across departments. Each sustainability metric is automatically assigned to specific stakeholders, creating accountability while eliminating confusion about who provides what information. The matrix incorporates hierarchical approval workflows that enable finance teams to maintain control while delegating collection responsibilities.

Our collection process visualization provides real-time status monitoring of all data inputs. Finance leaders gain immediate visibility into completion percentages, bottlenecks, and progress toward reporting deadlines. The system automatically flags delayed submissions and escalates critical data requirements to ensure timely completion.

The cross-departmental integration layer implements standardized data exchange protocols between traditionally siloed systems. Through configurable API connections, SFTP channels, and intuitive drag-and-drop interfaces, the platform accommodates various technical capabilities across departments while maintaining data consistency.

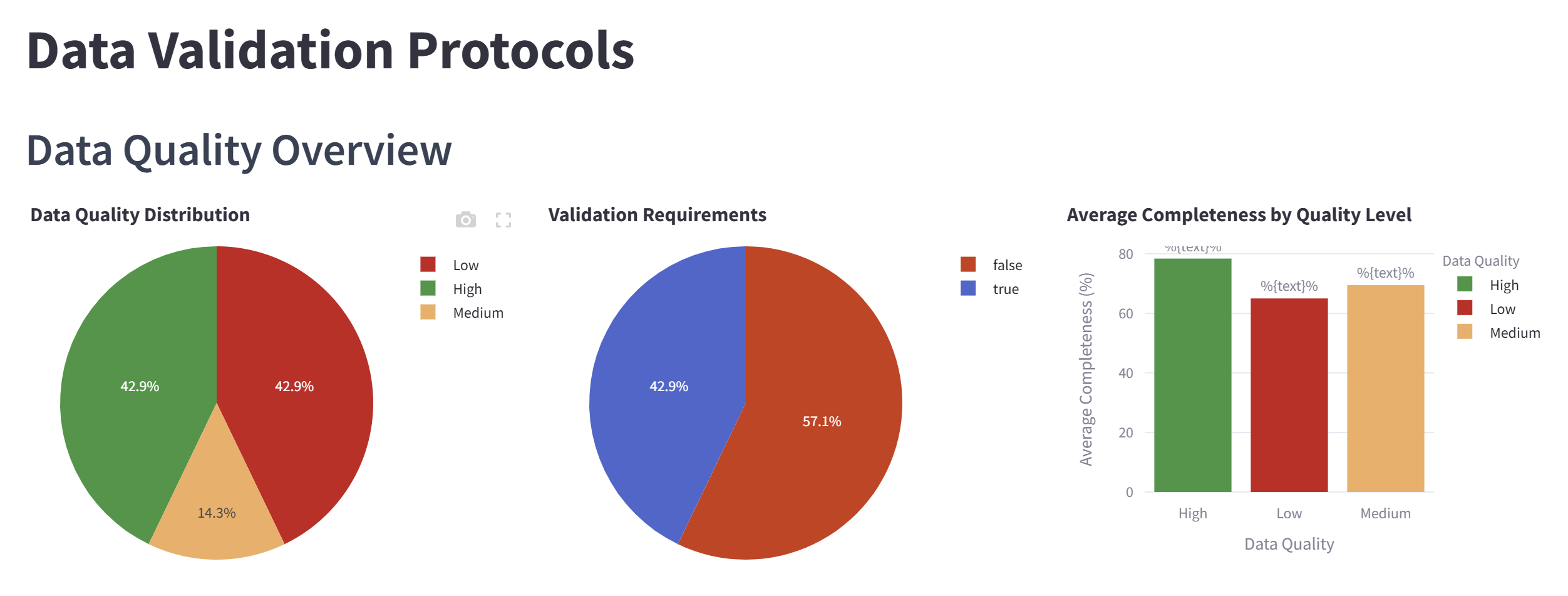

Data validation protocols enforce quality controls at multiple checkpoints throughout the collection process. The system applies both automated validation rules based on statistical thresholds and manual review procedures to identify anomalies, inconsistencies, and potential reporting gaps before they impact compliance.

Dynamic Visualization Dashboard

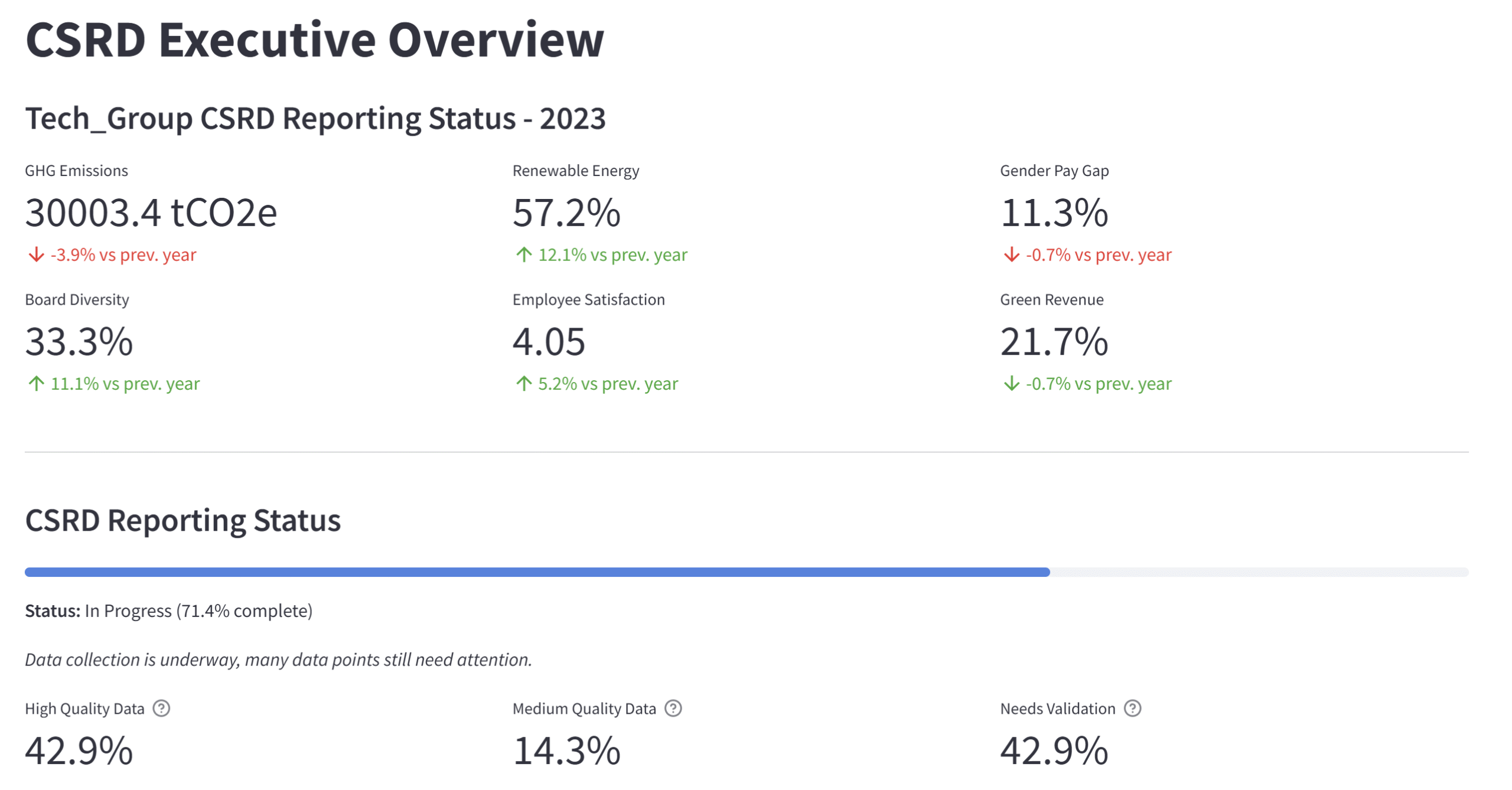

The solution transforms complex sustainability metrics into intuitive dashboards tailored to different stakeholder needs. Executive overviews provide leadership with strategic insights into sustainability performance, while operational dashboards offer granular data for day-to-day management.

Data completeness tracking visualizes collection progress through multi-dimensional heatmaps that highlight both departmental performance and thematic coverage. The system provides customizable alerts for potential data quality issues, enabling proactive intervention before submission deadlines.

Department-specific views present relevant metrics and responsibilities to each stakeholder group, creating personalized dashboards that increase engagement and accountability. Timeline management tools track reporting milestones against regulatory deadlines, providing early warning indicators for potential delays.

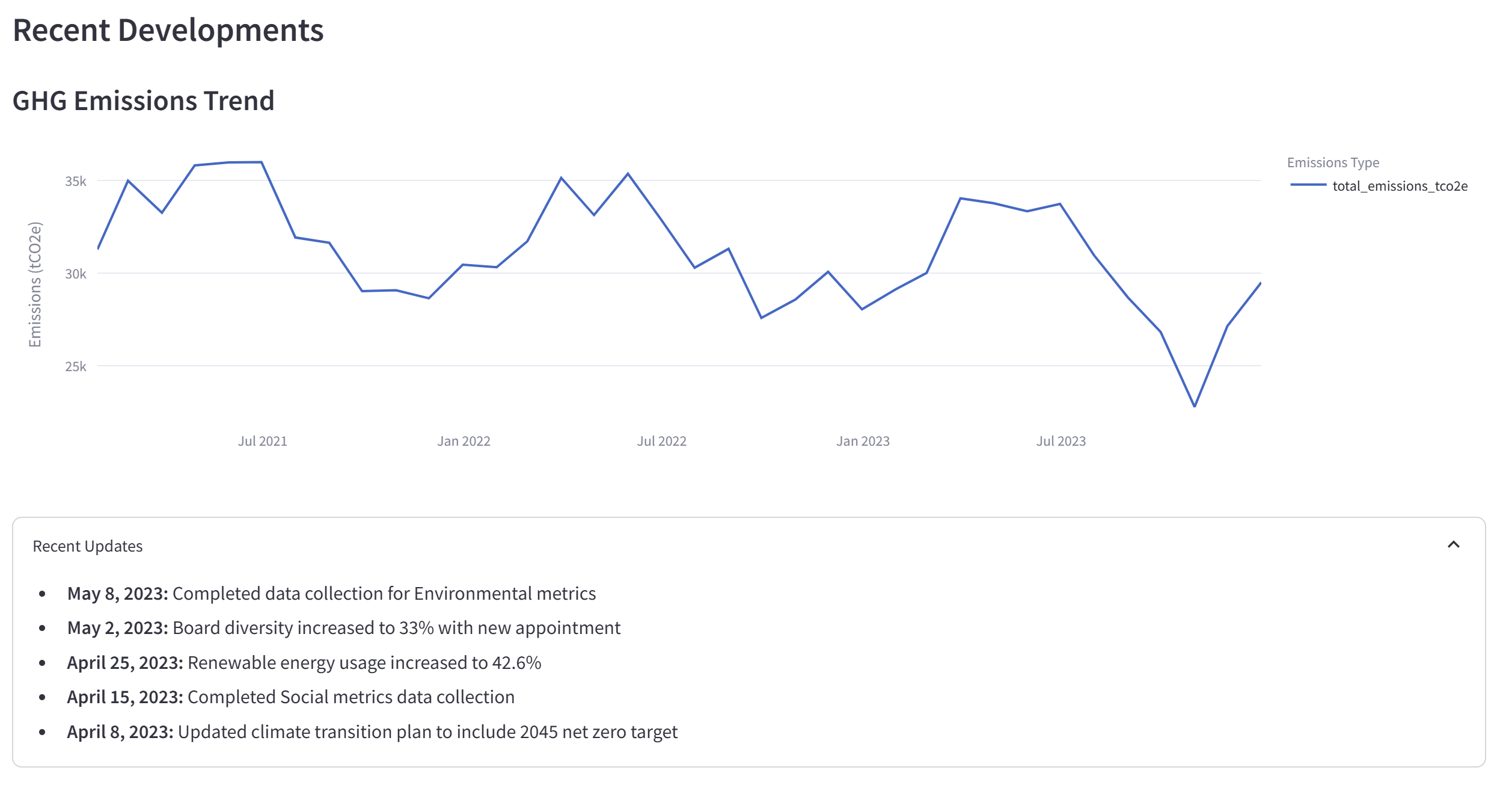

Sustainability metric visualization transforms complex ESG data into accessible formats that facilitate understanding and decision-making. Interactive charts, trend analysis, and benchmarking capabilities help finance teams identify performance outliers and improvement opportunities.

Enterprise-Grade Security and Deployment

The solution implements comprehensive security controls to protect sensitive ESG data. All connections utilize HTTPS encryption, while role-based authentication ensures appropriate access privileges across the organization. The platform maintains detailed audit logs of all system interactions to support compliance verification.

As a managed service, the solution eliminates the need for internal infrastructure investment or specialized technical resources. Implementation follows a structured methodology that accelerates deployment while minimizing disruption to existing operations. The platform’s scalable architecture accommodates growing data volumes and expanding reporting requirements.

Data exchange capabilities support diverse technical environments through multiple integration options. The intuitive drag-and-drop interface enables non-technical users to submit information without specialized training, while SFTP and API options support automated data flows from existing systems.

Each implementation receives comprehensive customization to address specific organizational needs. From industry-specific metrics to company-specific reporting structures, the solution adapts to unique requirements while maintaining compliance with CSRD standards.

Transformative Benefits for Finance Departments

Organizations implementing our CSRD Reporting Dashboard experience significant operational and strategic benefits. Finance departments report average time savings of 62% in data collection and validation activities compared to manual processes. One financial director noted that the system “transformed a three-month panic into a continuous, manageable process.”

The solution dramatically improves data quality through standardized collection and validation protocols. This quality improvement extends beyond compliance, enhancing decision-making capabilities throughout the organization.

Long-term benefits include improved sustainability performance as organizations gain visibility into ESG metrics and improvement opportunities. According to independent research, companies with integrated sustainability reporting systems achieve 23% greater improvement in environmental performance indicators over three years compared to those using fragmented approaches.

The platform also creates strategic value by transforming compliance activities into business intelligence. As one CFO explained, “What began as a CSRD compliance exercise has become a competitive advantage. We now understand our sustainability performance in ways that inform strategic planning and investor communications.”

Taking the Next Step Toward CSRD Excellence

Preparing for CSRD compliance requires immediate action. Organizations should begin by assessing their current data collection capabilities against reporting requirements, identifying gaps in both processes and systems. Our dashboard demo provides a concrete example of how these gaps can be addressed through purpose-built technology.

We recommend scheduling a personalized demonstration that incorporates your specific organizational structure and reporting needs. This tailored approach ensures you understand exactly how the solution would function within your unique environment. The demonstration includes a preliminary data mapping exercise that identifies key integration points with your existing systems.

Following the demonstration, our team provides a customized implementation roadmap that outlines timelines, resource requirements, and critical milestones for deployment. This roadmap serves as a practical guide for transforming CSRD compliance from an overwhelming challenge into a manageable process.

Remember, when it comes to CSRD reporting, the difference between stress and success often comes down to having the right tools – because trying to meet modern sustainability requirements with outdated systems is like bringing a abacus to a supercomputer competition.

Transform Your CSRD Reporting Today

Contact us now to schedule your personalized CSRD Reporting Dashboard demonstration using your own data structures. Join forward-thinking finance leaders who have transformed regulatory compliance into operational excellence. Don’t risk penalties or reputational damage from inadequate reporting – implement a solution designed specifically for CSRD success.

By submitting this form, you agree that Finaprins may contact you occasionally via email to make you aware of Finaprins products and services. You may withdraw your consent at any time. For more details see the Finaprins Privacy Policy.